Resources

Round-Tripping

In this edition, we will delve into the concept of Round-Tripping, its definition, practical examples, statistics, and...

Adverse Media Screening

In this edition, we will discuss the importance of Adverse Media Screening, its definition, practical examples, statistics,...

International Compliance Association (ICA)

In this edition, we will delve into the International Compliance Association (ICA), its definition, practical examples, statistics,...

Non-Cooperative Countries or Territories (NCCTs)

In this edition, we will delve into the significance of Non-Cooperative Countries or Territories (NCCTs), its definition,...

Source of Funds (SoF)

In this edition, we will delve into the significance of Source of Funds (SoF), its definition, practical...

Source of Wealth (SoW)

In this edition, we will delve into the significance of Source of Wealth (SoW), its definition, practical...

Suspicious Matter Report (SMR)

A Suspicious Matter Report (SMR) is a crucial tool in anti-money laundering efforts. It is a formal...

Compliance Assurance

Compliance assurance refers to the process of ensuring that an organization's policies, procedures, and practices comply with...

Customer Activity Report (CAR)

A Customer Activity Report (CAR) is a critical tool used in anti-money laundering efforts. It provides a...

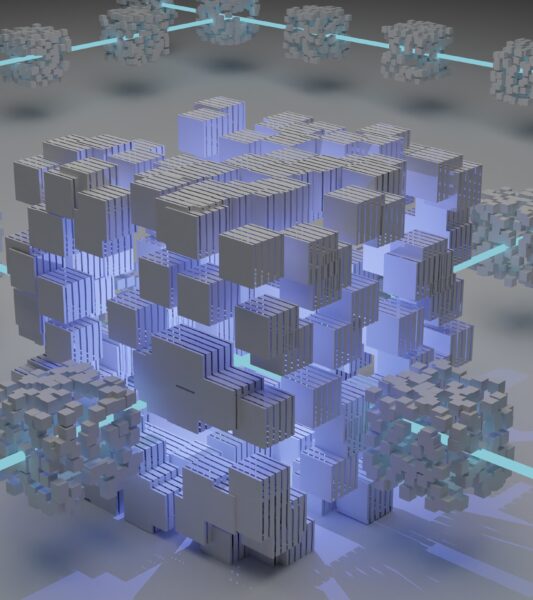

Blockchain Forensics

This dictionary guide explores the field of blockchain forensics, which involves the analysis and investigation of transactions...