Simplify Compliance.

Accelerate Growth.

An all in one platform for fraud prevention, and compliance operations. Drive growth for your business with Kyros AML.

Trusted by Industry Leaders in

Fintech, Crypto, Payments, and More.

KyrosAML empowers businesses to build trust with their customers and stakeholders by ensuring compliance with the highest regulatory standards.

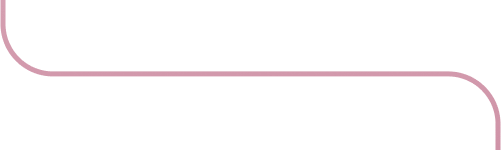

Comprehensive Solutions for

KYC and AML Compliance.

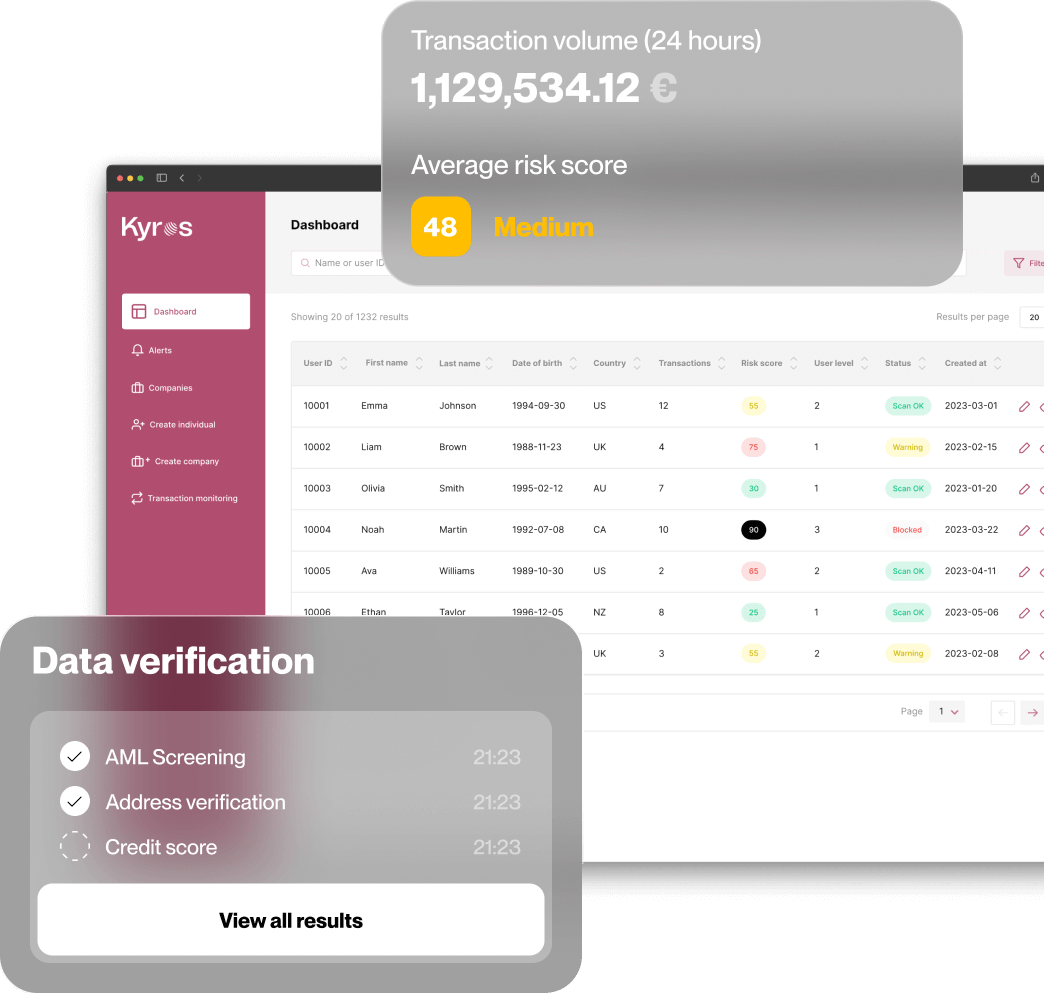

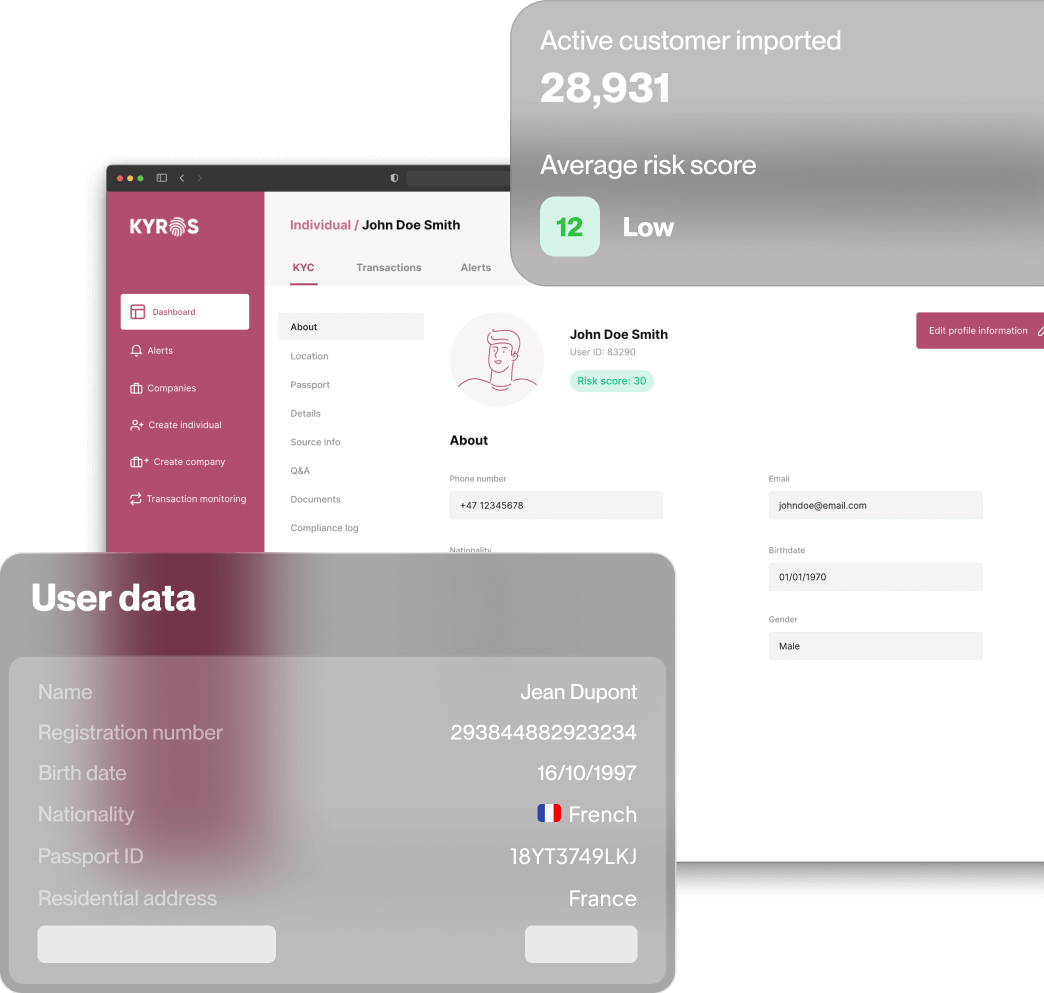

An integrated dashboard for you to manage all your compliance operations.

More about Kyros Data Suite

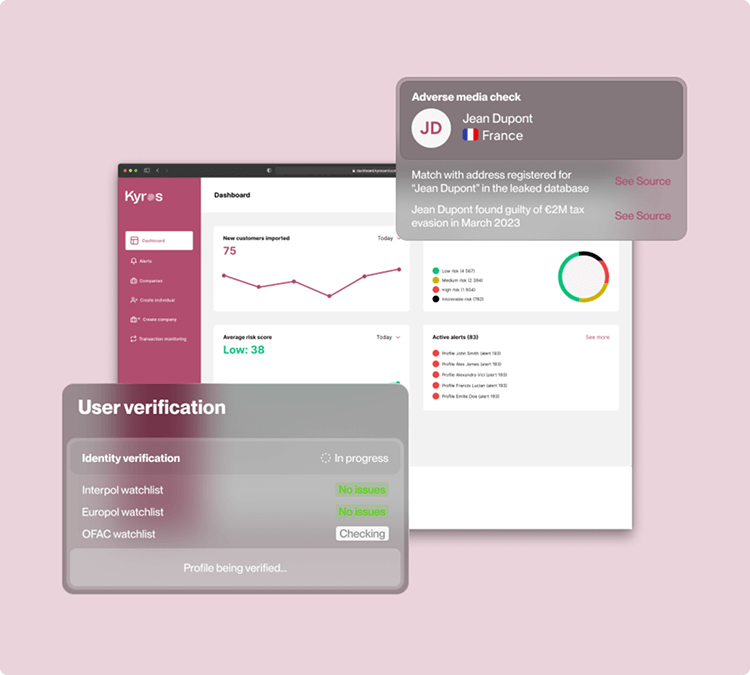

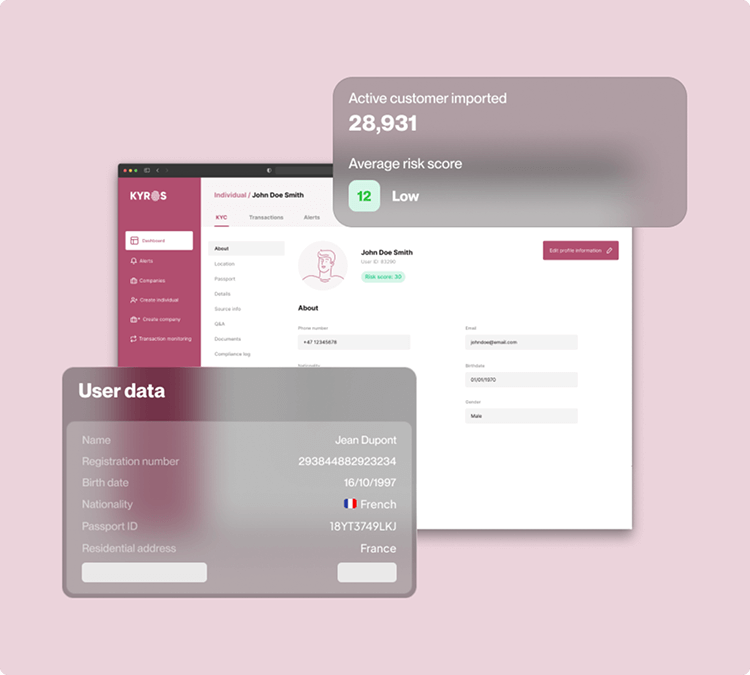

AML Screening

More about KyrosAML Screening

Data Enrichment

More about Kyros Data Enrichment

We help businesses simplify compliance

so they can focus on their growth.

Rapid deployment tailored to your needs

KyrosAML understands that every business is unique. Our solutions are designed to launch quickly and adapt to your specific requirements, ensuring you’re up and running in no time. Whether you’re tackling industry-specific regulations or scaling operations, we provide the agility you need to stay ahead.

Scalable solutions for businesses of any size

From startups to global enterprises, KyrosAML offers flexible solutions that grow with you. Our platform adjusts seamlessly as your business expands, ensuring compliance needs are met at every stage without compromising efficiency or performance.

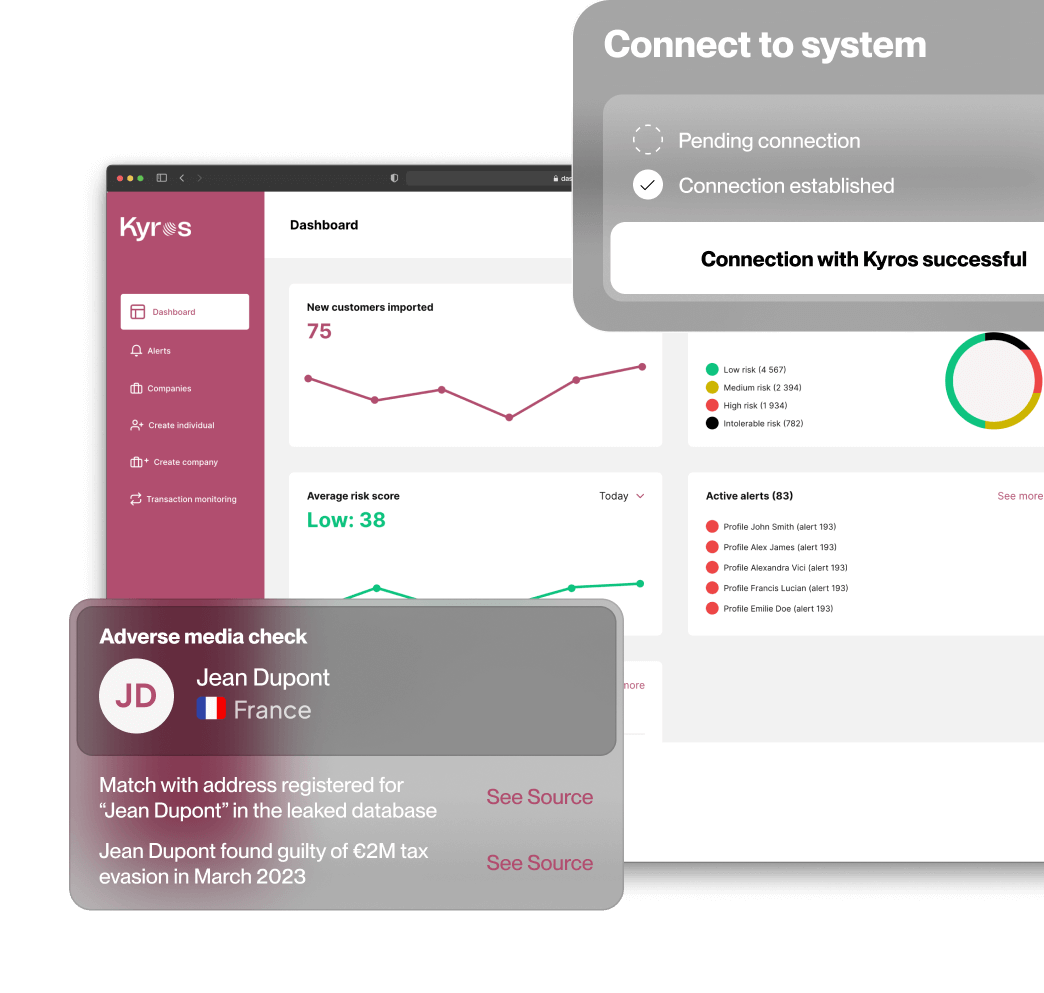

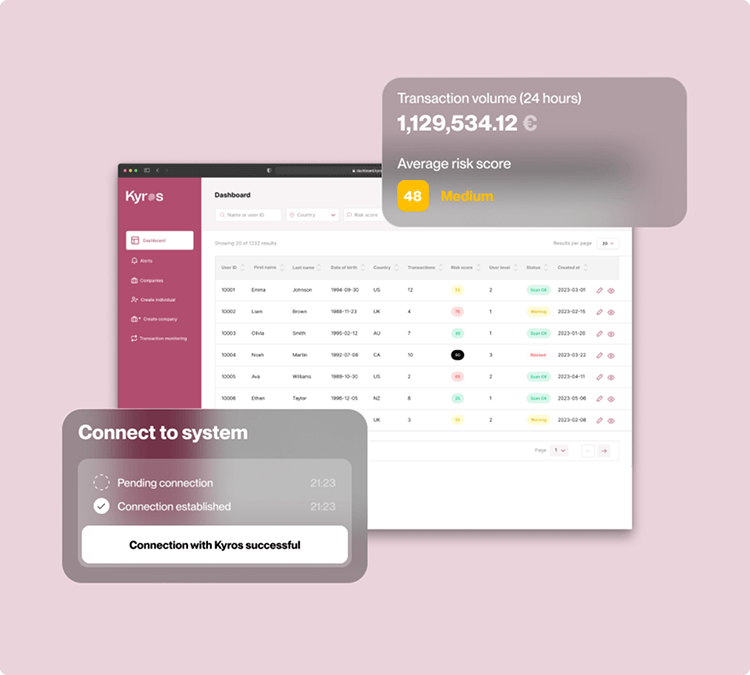

Seamless integration via robust API

Our robust API makes it simple to integrate KyrosAML into your existing systems, enhancing your compliance processes without disrupting operations. Whether you’re integrating with internal workflows or external platforms, Kyros ensures a smooth and efficient experience.

Global coverage with compliance across 200+ jurisdictions

KyrosAML provides comprehensive compliance coverage in over 200 jurisdictions, helping businesses navigate the complexities of international regulations. With our global reach and local expertise, you can confidently expand into new markets while staying compliant.

As seen in

Solutions tailored

for your industry.

Navigate the fast-evolving world of digital assets with confidence. KyrosAML provides robust compliance tools to handle the unique challenges of cryptocurrency and blockchain, ensuring secure and compliant operations in this dynamic industry.

The iGaming industry faces stringent regulations to combat fraud and money laundering. KyrosAML supports gaming operators by delivering robust, scalable AML and KYC solutions that enhance player trust while meeting compliance requirements.

In the ever-expanding payments industry, ensuring secure and compliant transactions is paramount. KyrosAML provides tailored solutions to help payment processors and gateways meet regulatory demands across jurisdictions.

In the ever-expanding payments industry, ensuring secure and compliant transactions is paramount. KyrosAML provides tailored solutions to help payment processors and gateways meet regulatory demands across jurisdictions.

In the ever-expanding payments industry, ensuring secure and compliant transactions is paramount. KyrosAML provides tailored solutions to help payment processors and gateways meet regulatory demands across jurisdictions.

The transport and logistics sector faces unique compliance challenges due to its global operations. KyrosAML offers tailored solutions to address these complexities and ensure secure and compliant transactions.

Join the businesses already transforming their AML and KYC operations with KyrosAML.

Discover how KyrosAML can work for you.