Resources

AML/CFT Standards: Ensuring a Secure Financial Landscape

"The fight against money laundering and terrorist financing is a global responsibility that requires collaboration and commitment...

Regulatory Backstop

"The presence of a robust regulatory backstop is instrumental in fostering confidence in the financial system and...

Customer Identification Program (CIP)

"The Customer Identification Program is not just a regulatory obligation; it is a critical tool in the...

Politically Exposed Entities (PEEs)

Politically Exposed Entities (PEEs) refer to individuals who hold prominent public positions or have close associations with...

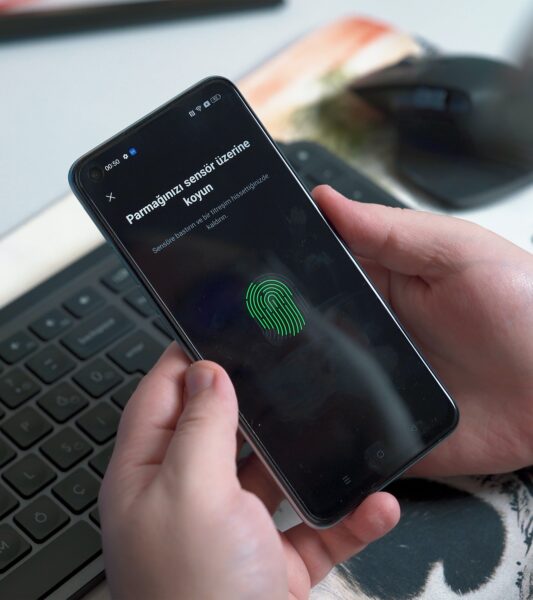

Global KYC Requirements

Global Know Your Customer (KYC) requirements refer to the regulatory obligations imposed on financial institutions and businesses...

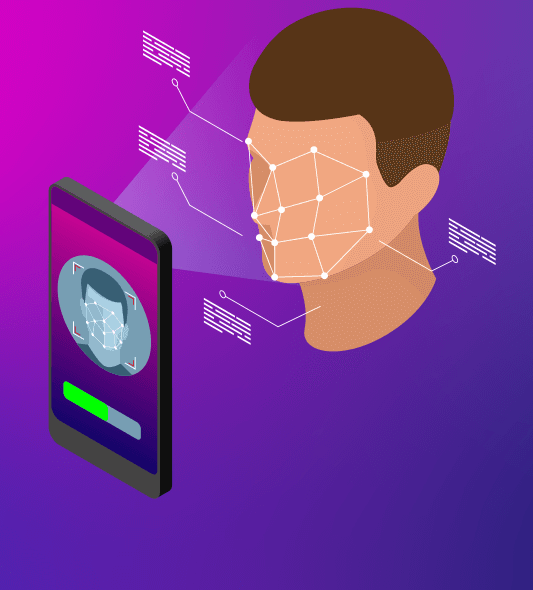

Digital Identity Verification

Digital identity verification plays a vital role in verifying the authenticity and integrity of individuals in the...

De-risking Strategy

Learn about de-risking strategy and how it helps financial institutions manage risks, streamline operations, and stay compliant...

Straw Man Accounts in AML

Discover the ins and outs of strawman accounts in this comprehensive guide tailored for AML professionals. Explore...

Source of Funds (SoF)

In this edition, we will delve into the significance of Source of Funds (SoF), its definition, practical...

Source of Wealth (SoW)

In this edition, we will delve into the significance of Source of Wealth (SoW), its definition, practical...