Resources

Regulatory Reporting

Regulatory reporting refers to the process of submitting timely and accurate reports to regulatory authorities as required...

AML Internal Controls

AML Internal Controls refer to the policies, procedures, and processes implemented within an organization to detect, prevent,...

Reporting Obligations in Anti-Money Laundering (AML) Compliance: A Broad Dictionary Guide

Financial institutions have reporting obligations to fulfill when they come across transactions or activities that raise suspicions...

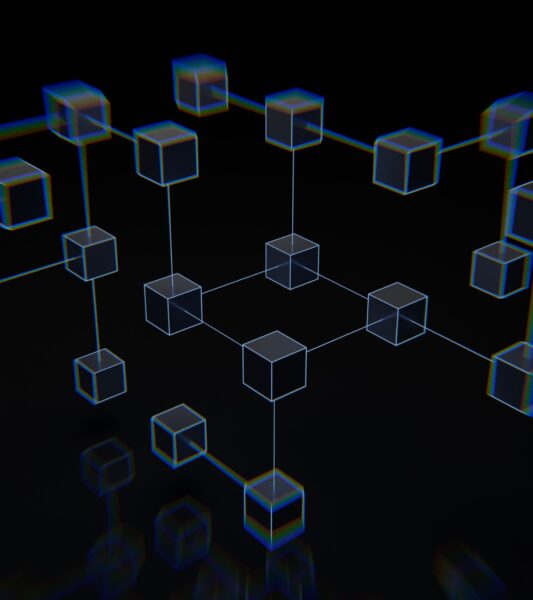

Blockchain Analysis

Blockchain analysis refers to the process of investigating and examining transactions recorded on a blockchain network to...

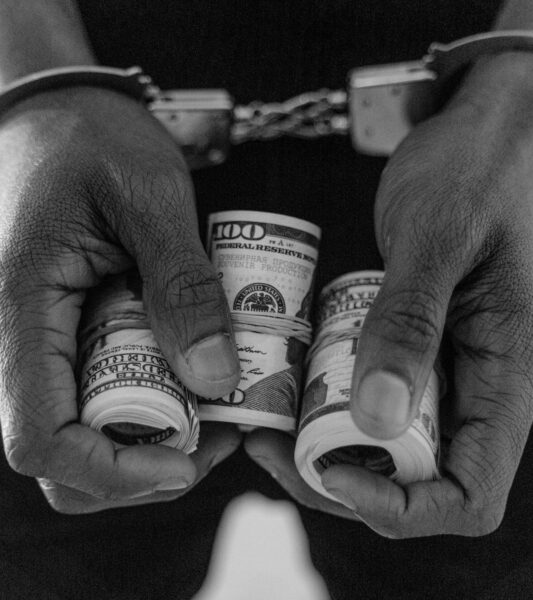

Money Laundering Stages: Placement, Layering, Integration

Money laundering is a process through which illegally obtained funds made to appear legitimate by disguising their...

AML Audit

An AML audit refers to a comprehensive assessment and evaluation of an organization's Anti-Money Laundering (AML) program...

Bank Secrecy Act (BSA)

The Bank Secrecy Act (BSA) is a federal law enacted in the United States in 1970 that...

Currency Transaction Report (CTR)

When an individual or business deposits a significant amount of cash, typically above a specified threshold (currently...

Financial Crimes Enforcement Network (FinCEN)

"FinCEN and its counterparts around the globe must continue to cooperate and innovate together." -Sigal Mandelker

A Guide to KYC and AML Policies

Explore the importance of international AML cooperation and information sharing in combating money laundering. Understand the collaborative...