Resources

Compliance Risk

Compliance risk refers to the potential for an organization to violate laws, regulations, industry standards, or internal...

The Role of KYC and AML Regulations in Preventing Financial Fraud

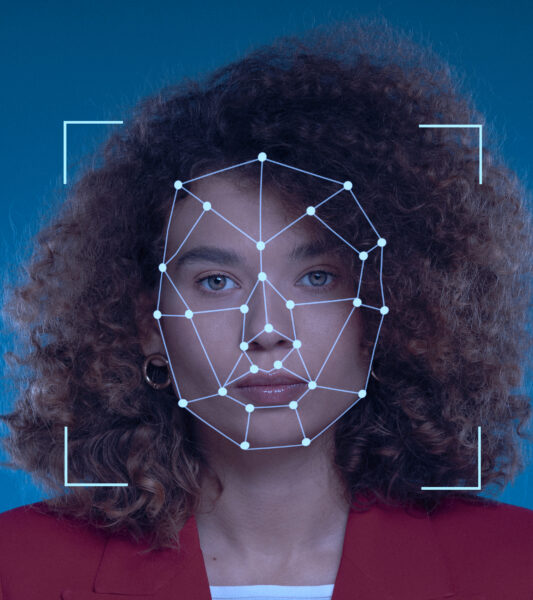

Together, AML regulations and KYC procedures form the first line of defense against financial fraud. As we...

Practical Guide to Implementing the EU Travel Rule Regulation

The EU Travel Rule has emerged as a key aspect of the EU's commitment to combat money...

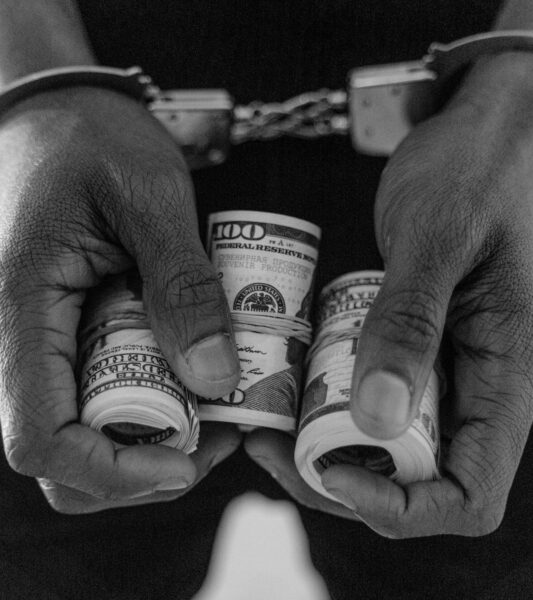

Money Laundering Stages: Placement, Layering, Integration

Money laundering is a process through which illegally obtained funds made to appear legitimate by disguising their...

AML Audit

An AML audit refers to a comprehensive assessment and evaluation of an organization's Anti-Money Laundering (AML) program...

Bank Secrecy Act (BSA)

The Bank Secrecy Act (BSA) is a federal law enacted in the United States in 1970 that...

Currency Transaction Report (CTR)

When an individual or business deposits a significant amount of cash, typically above a specified threshold (currently...

Financial Crimes Enforcement Network (FinCEN)

"FinCEN and its counterparts around the globe must continue to cooperate and innovate together." -Sigal Mandelker

4th Anti-Money Laundering Directive (4AMLD)

"The 4th Anti-Money Laundering Directive (4AMLD) is a critical tool in the fight against money laundering and...

Understanding the Risks of Non-Compliance with KYC and AML Regulations

We will delve deeper into the specifics of KYC and AML regulations, explore the risks associated with...