The Role of KYC and AML Regulations in Preventing Financial Fraud

Together, AML regulations and KYC procedures form the first line of defense against financial fraud. As we delve deeper into this topic, we will explore how these two mechanisms work hand in hand to protect the integrity of our financial systems.

Written by Erling Andersen

Written by Erling Andersen

In 2018, one of the largest banks in Europe found itself at the center of a massive money laundering scandal. Over $230 billion had flowed through its Estonian branch unchecked for almost a decade. It was a catastrophic failure of oversight that threatened to shake the bank to its core. However, thanks to stringent Anti-Money Laundering (AML) regulations and Know Your Customer (KYC) procedures, illicit activities were eventually detected and stopped. This real-life case underscores the critical importance of AML and KYC in the financial world.

AML regulations are a set of procedures, laws, or regulations designed to stop the practice of generating income through illegal actions. In most cases, money launderers hide their actions through a series of steps that make it look like money coming from illegal or unethical sources was earned legitimately. AML regulations help to prevent such activities by requiring financial institutions to put controls in place to detect and report suspicious activities.

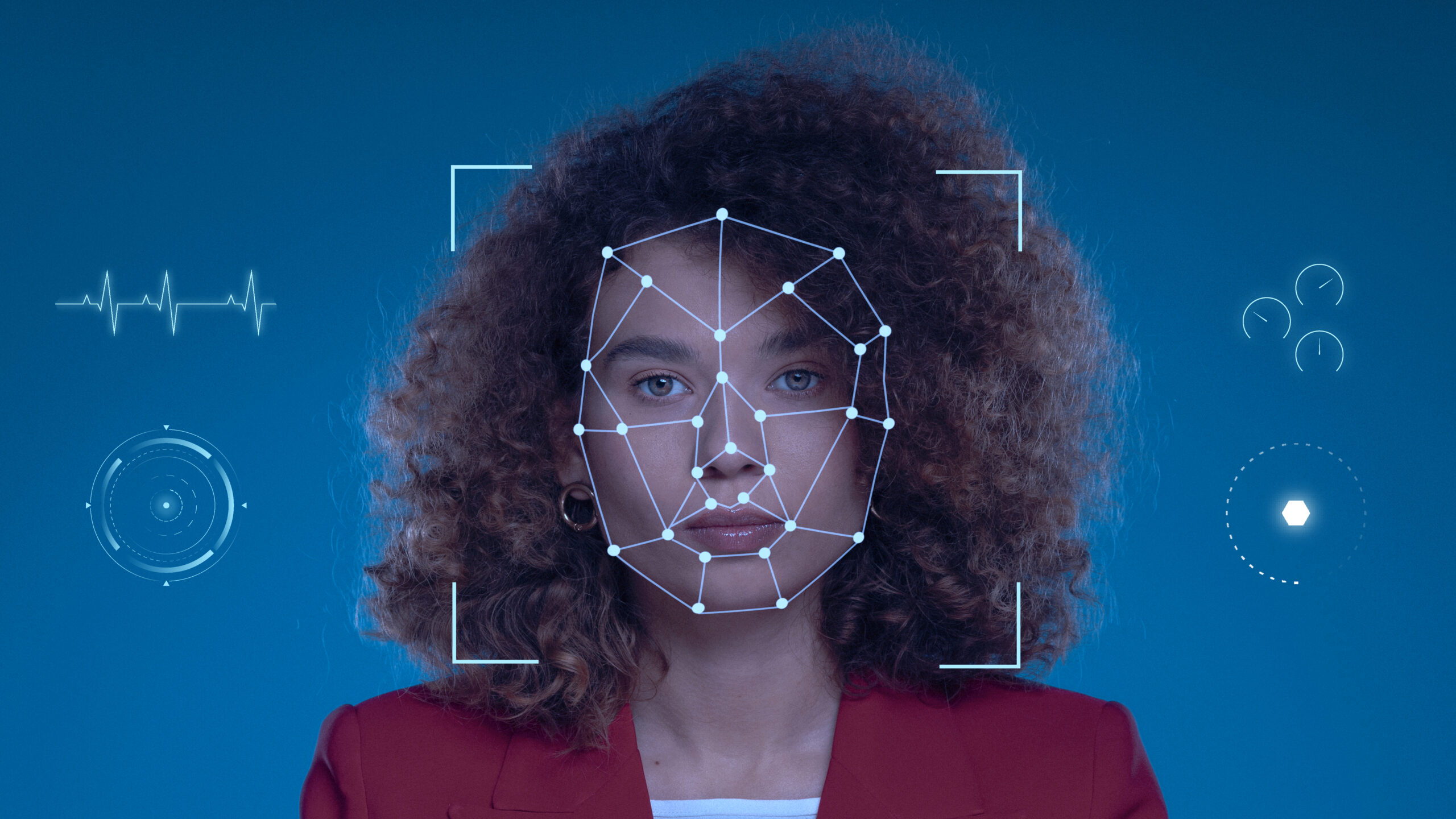

KYC, on the other hand, is a process that allows institutions to ensure that their clients are genuinely who they claim to be. This process involves collecting and verifying the personal information of customers. KYC procedures are crucial in preventing identity theft, financial fraud, money laundering, and terrorist financing.

Together, AML regulations and KYC procedures form the first line of defense against financial fraud. As we delve deeper into this topic, we will explore how these two mechanisms work hand in hand to protect the integrity of our financial systems.

The Intricacies of KYC (Know Your Client)

KYC (Know Your Customer) is a fundamental component of AML compliance. It refers to the process through which financial institutions and other entities verify the identity of their customers, assess their risk profiles, and gather relevant information to establish a business relationship. KYC procedures involve collecting identification documents, verifying the accuracy of customer information, and conducting risk assessments based on factors such as the customer’s identity, financial activities, and geographic location. The goal of KYC is to ensure that institutions have a clear understanding of their customers’ identities, intentions, and potential risks to prevent illicit activities, maintain regulatory compliance, and protect against financial crime.

KYC, or Know Your Client, has come a long way from its early days. Initially, KYC was primarily about verifying the identity of the client. However, as financial fraud became more sophisticated, so did KYC procedures. Today, KYC goes beyond identity verification. It involves understanding the client’s financial behaviors, risk tolerance, and even their business relationships. This comprehensive client profile helps financial institutions detect suspicious activities that could indicate financial fraud or money laundering.

The Three Pillars of KYC

KYC is built on three pillars: Customer Identification Program (CIP), Customer Due Diligence (CDD), and Enhanced Due Diligence (EDD).

- The CIP involves verifying the client’s identity and checking whether the client appears on any list of known or suspected terrorists or terrorist organizations.

- The CDD involves understanding the client’s financial behaviors and risk profile.

- The EDD is an additional layer of checks for high-risk clients, involving a more detailed examination of the client’s activities and relationships.

Case Study: A Successful Implementation of KYC in a Major Bank

In 2020, a major bank successfully prevented a multi-million dollar fraud scheme thanks to its robust KYC procedures. The bank’s KYC system flagged a series of transactions that seemed out of line with the client’s usual financial behavior.

Upon further investigation, the bank discovered that the client’s account had been compromised and was being used to funnel money to offshore accounts. This case highlights the power of effective KYC procedures in preventing financial fraud.

The Challenges and Solutions in KYC Implementation

Implementing KYC procedures is not without its challenges. Financial institutions often grapple with issues such as data privacy, technological limitations, and compliance with a myriad of regulations. However, advancements in technology, particularly in areas such as data analytics and artificial intelligence, are helping to overcome these challenges. For instance, AI can automate the process of verifying client identities and detecting suspicious activities, making KYC procedures more efficient and effective.

The Intersection of KYC and AML Regulations

KYC and AML regulations are two sides of the same coin. While KYC focuses on knowing the client, AML focuses on preventing illegal activities such as money laundering. The information gathered through KYC procedures can help financial institutions comply with AML regulations by enabling them to detect and report suspicious activities. According to the Financial Action Task Force (FATF), an effective AML program is one that incorporates robust KYC procedures.

In the next section, we will delve into the power of AML regulations and how they work hand in hand with KYC to prevent financial fraud.

The Power of AML Regulation (Anti-Money Laundering)

AML (Anti-Money Laundering) refers to the set of laws, regulations, and procedures implemented by financial institutions and other regulated entities to prevent and detect activities related to money laundering and terrorism financing. The objective of AML measures is to ensure that financial systems are not misused for illegal purposes, such as disguising the origins of illicit funds or funding criminal activities.

Anti-Money Laundering (AML) regulations have been a cornerstone of financial security for decades. Born out of the need to curb illicit activities like drug trafficking and organized crime, AML regulations have evolved to combat an array of financial crimes, including fraud, corruption, and tax evasion. Today, AML regulations are a complex network of laws and directives that require financial institutions to monitor customer transactions and report suspicious activities.

The Impact of AML on the Global Financial Landscape

The influence of AML regulations on the global financial landscape cannot be overstated. According to the United Nations Office on Drugs and Crime, the estimated amount of money laundered globally in one year is 2 – 5% of global GDP, or $800 billion – $2 trillion in current US dollars. By requiring financial institutions to put controls in place to detect and report suspicious activities, AML regulations play a crucial role in preventing the flow of illicit money and maintaining the integrity of global financial systems.

Case Study: How AML Regulations Dismantled a Major Money Laundering Operation

In 2017, AML regulations played a pivotal role in dismantling a major international money laundering operation. A global bank, using its AML systems, detected a series of suspicious transactions involving multiple offshore accounts. The bank reported these transactions to the authorities, leading to a multi-national investigation that ultimately dismantled a money laundering operation spanning three continents. This case underscores the effectiveness of AML regulations in detecting and preventing financial crimes.

The Future of AML: Emerging Trends and Technologies

As financial criminals become more sophisticated, so too must AML regulations and the technologies that support them. Emerging trends in AML include the use of artificial intelligence and machine learning to detect suspicious activities, the integration of KYC and AML systems, and the development of global AML standards. These advancements promise to make AML regulations even more effective in the fight against financial crime.

The Symbiosis of AML Regulations and KYC Procedures

AML regulations and KYC procedures are two sides of the same coin. Both are essential for detecting and preventing financial fraud. AML regulations require financial institutions to monitor customer transactions and report suspicious activities, while KYC procedures ensure that financial institutions know who their customers are and understand their financial behaviors. Together, AML regulations and KYC procedures form a formidable defense against financial fraud.

In the next section, we will explore how these two mechanisms work together in the financial industry, providing real-world examples of their effectiveness in preventing financial fraud.

The Symbiosis of KYC and AML in Preventing Financial Fraud

KYC and AML are not isolated processes; they are interconnected and mutually reinforcing. KYC procedures provide the foundation for effective AML compliance. By knowing their customers, financial institutions can better understand what constitutes normal and expected behavior, making it easier to spot anomalies that may indicate money laundering or other forms of financial fraud. Conversely, AML regulations provide a framework for monitoring and reporting suspicious activities, which is only possible if the financial institution has a thorough understanding of its customers through effective KYC procedures.

Real-world Examples of KYC and AML Working Hand-in-Hand to Prevent Financial Fraud

There are numerous examples of KYC and AML working together to prevent financial fraud. For instance, in 2019, a major European bank was able to prevent a multi-million dollar fraud scheme thanks to its robust KYC procedures and AML systems. The bank’s KYC procedures helped it identify a series of transactions that were inconsistent with the client’s profile. Its AML systems then flagged these transactions as suspicious, leading to a thorough investigation that ultimately uncovered a complex fraud scheme.

The Role of Technology in Enhancing KYC and AML Effectiveness

Technology plays a crucial role in enhancing the effectiveness of KYC and AML. Advanced data analytics, artificial intelligence, and machine learning can automate many aspects of KYC and AML, making them more efficient and accurate. For example, AI can be used to analyze vast amounts of transaction data to identify patterns that may indicate fraudulent activity. Similarly, machine learning algorithms can learn from past cases of fraud to predict and prevent future instances.

The Impact of KYC and AML on Financial Institutions

The impact of KYC and AML on financial institutions is significant. According to a report by LexisNexis, financial firms spend more than $180 billion annually on compliance, with a significant portion of this amount going towards KYC and AML compliance. While this represents a substantial cost, the benefits of KYC and AML in terms of preventing financial fraud and maintaining the integrity of the financial system far outweigh the costs.

In the next section, we will delve into the challenges and future of KYC and AML, exploring how financial institutions can overcome the hurdles in implementing these regulations and what the future holds for KYC and AML.

The Challenges and Future of KYC and AML

Implementing and maintaining KYC and AML regulations is a complex task. Financial institutions face numerous challenges, including the need to navigate a myriad of regulations that vary across jurisdictions, the difficulty of verifying customer identities in an increasingly digital world, and the high costs associated with compliance. According to a survey by Thomson Reuters, some large financial institutions spend up to $500 million annually on KYC and customer due diligence.

The Role of Technology in Overcoming These Challenges

Technology is playing a crucial role in helping financial institutions overcome these challenges. Advanced data analytics, artificial intelligence, and machine learning are being used to automate many aspects of KYC and AML, making them more efficient and accurate. For example, AI can be used to analyze vast amounts of transaction data to identify patterns that may indicate fraudulent activity. Similarly, machine learning algorithms can learn from past cases of fraud to predict and prevent future instances.

The Future of KYC and AML: Predictions and Expectations

The future of KYC and AML looks promising. As technology continues to advance, we can expect KYC and AML to become even more efficient and effective. For example, the use of blockchain technology could revolutionize KYC by creating a decentralized and immutable record of customer identities. Similarly, the use of AI in AML could lead to more accurate detection of suspicious activities and faster reporting of potential fraud.

The Importance of Staying Ahead of the Curve

As financial fraud continues to evolve, so too must KYC and AML. Financial institutions must stay ahead of the curve by continually updating their KYC and AML procedures and leveraging the latest technologies. By doing so, they can ensure that they are well-equipped to detect and prevent financial fraud, protecting their customers and the integrity of the financial system.

In the next section, we will conclude our exploration of KYC and AML, summarizing their importance in preventing financial fraud and offering some final thoughts and insights.

Conclusion

As we’ve explored in this article, the importance of KYC and AML in today’s financial world cannot be overstated. These regulations and procedures form the first line of defense against financial fraud, protecting both financial institutions and their customers. According to the United Nations Office on Drugs and Crime, the estimated amount of money laundered globally in one year is 2 – 5% of global GDP, or $800 billion – $2 trillion in current US dollars. These staggering figures underscore the critical role of KYC and AML in safeguarding our financial systems.

Technology plays a crucial role in enhancing the effectiveness of KYC and AML. Advanced data analytics, artificial intelligence, and machine learning are revolutionizing these procedures, making them more efficient, accurate, and cost-effective. As financial fraud continues to evolve, leveraging these technologies will be key to staying ahead of the curve.

In this context, the Kyros AML Data Suite stands out as a powerful tool for financial institutions. This AML compliance SaaS software offers a comprehensive solution for managing KYC and AML compliance. It leverages advanced technologies to automate many aspects of KYC and AML, making them more efficient and accurate.

KYC and AML are critical tools in the fight against financial fraud. By leveraging advanced technologies and solutions like the Kyros AML Data Suite, financial institutions can enhance their KYC and AML procedures, stay compliant with regulations, and protect their customers and the financial system from the threat of financial fraud.

Share article on