As seen in

What is Kyros?

We like to say Kyros Anti-Money Laundering Suite is compliance's new best friend. Discover why below.

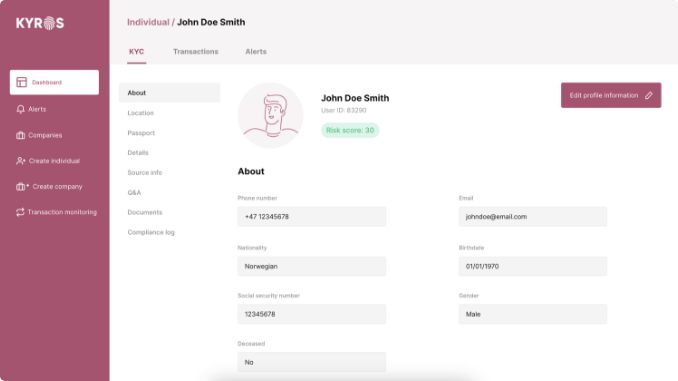

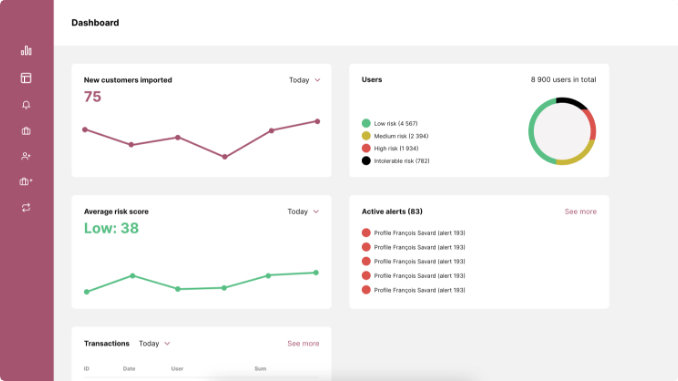

Cloud-based dashboard solution

Kyros is a cloud-based AML software solution, with native API support and support for more than 200 countries. Kyros supports you in onboarding and monitoring your customers and their transactions, working in conjunction with your regular backoffice.

Designed for financial institutions

As a top AML compliance software, Kyros is designed for financial institutions like banks, EMIs, cryptocurrency exchanges, accountants, casinos, brokers, funds, auction houses, real estate agents, lawyers and more.

Single source of truth

Kyros acts as a single source of truth for the organization’s entire value chain of AML operations. No other systems are required. PEP, sanction checks, KYC, transaction monitoring, STR/SAR reporting – you name it, Kyros has it.

The Best vs. The Rest

Compare the unique product features of Kyros AML Suite against other typical KYC and providers.

| Kyros AML Suite | Stand-alone KYC solutions | Sanction Scanner Tools | Excel-Supported AML Operations | |

|---|---|---|---|---|

| KYC | ||||

| Global KYC verification | ||||

| Electronic identity verification (eIDV) | ||||

| Non individuals / KYB | ||||

| UBO identification | ||||

| Integrated KYC case management | ||||

| PEP, sanctions and adverse media checks | ||||

| Embeddable self-declaration PEP form | ||||

| Data import | ||||

| Fully cloud-based AML dashboard | ||||

| GDPR-compliant EU data processing | ||||

| API webhooks for easy data exchange | ||||

| Customizable data sources | ||||

| Document storage | ||||

| Easy data export | ||||

| Risk assessment | ||||

| Automatic risk scoring with custom risk factors | ||||

| Customizable risk matrix | ||||

| Integrated risk-based AML flows | ||||

| Built-in support for SDD / EDD processes | ||||

| AML Alerts system | ||||

| Transaction monitoring | ||||

| Transaction monitoring with threshold alerts | ||||

| Financial accounts monitoring | ||||

| AML Logs and Auditing | ||||

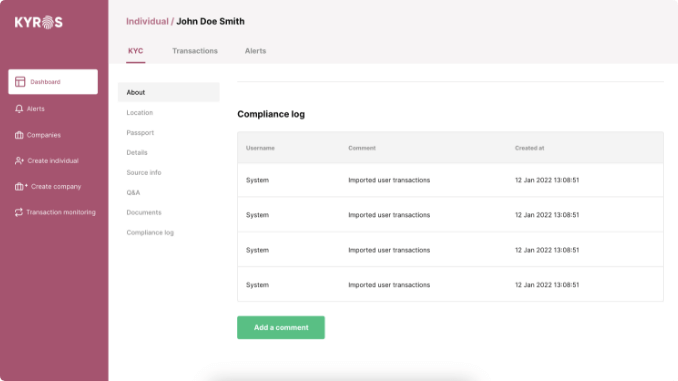

| Auditor friendly compliance actions log | ||||

| Automatic SAR / STR report generation | ||||

The Kyros Anti-Money Laundering Workflow

Import

Kyros works in conjunction with your existing website, back office or CRM-system. Kyros retrieves basic user information and transaction logs via API or manual upload.

Enrich

Kyros analyzes the data and enriches it with supplemental information from premium third-party sources, including international PEP and sanction lists. You can also integrate Kyros-hosted self declaration forms into your onboarding flow.

Authenticate

Trigger on-demand strong customer authentication (SCA) via SMS and email. Document the users’ identity and answers to relevant AML compliance questions.

Risk score

AI analyzes the enriched data and automatically risk-scores users based on individualized risk parameters that you control.

Monitor

Kyros offers live transaction monitoring of all transactions, allowing you to setup advanced alert rules for user behavior and transaction data – such as triggering EDD based on transaction limits.

Log

All compliance work is performed in the cloud-based Kyros Data Suite. All compliance actions are logged, allowing for easy third-party auditing.

Report

Create automatic in-depth reports for easy Suspicious Activity Report (SAR) and Suspicious Transaction Report (STR) reporting. Export to PDF and upload to your relevant financial authority.

Export

You can use Kyros Data Suite on its own, or as an integrated part of your backoffice. Data can be exchanged seamlessly back and forth. API webhooks allow for automated back office decision-making.

Who is Kyros AML Compliance Suite For?

- Banks

- EMIs

- Casinos

- Crypto exchanges

- Brokers

- Funds

- Auction houses

- Real estate agents

- Lawyers

and more…

Trusted by

Kyros Data Sources

First-party data from backoffice or CRM

Live transaction data

EU e-IDs like BankID, MobileID and NemID

UN, US, EU and international PEP and sanction lists

Trulioo Identity Verification

Address verification sources

Adverse media

Passport authentication

D&B credit reports

International tax registries

Kyros Customer Testimonials

“Super happy with Kyros’ anti-money laundering software so far. It helps us streamline our AML operations and greatly increases onboarding speed. You really get a sense of control over your customer base.”

“Kyros saves us a lot of time. Manual work is automated, and reporting, both to our MLRO and regulator, is sped up. Also, the logging is auditor-friendly, ensuring we excel as an organization. I’d say Kyros is one of the best AML compliance software suites out there.

Invest in AML Compliance and Avoid Fines

The Importance of AML Compliance Software

Discover what to look for in an AML solution - and why many rate Kyros as one of the best AML compliance software suites arond.

Why prioritize AML?

Prioritizing Anti-Money Laundering (AML) work is essential for companies, particularly in the financial sector, to ensure compliance with increasingly stringent global regulations.

These regulations are not uniform but vary across jurisdictions, requiring a nuanced approach to compliance. Failure to adhere to these regulations can result in substantial financial penalties and legal consequences, including criminal charges. More than just a financial burden, these penalties can significantly tarnish a company’s public image and credibility.

In today’s business environment, a company’s reputation is invaluable, and any association with money laundering activities can severely damage trust and confidence among clients, partners, and the wider public. This erosion of trust can have long-lasting effects, potentially leading to a loss of business and difficulties in establishing new partnerships or expanding operations.

Effective AML compliance, facilitated by robust AML compliance software, plays a crucial role in identifying and mitigating risks associated with financial crimes.

What to Consider?

When choosing an AML compliance software, financial institutions must focus on the software’s ability to integrate effectively with existing systems for seamless data management.

It’s essential that the software offers comprehensive features like transaction monitoring, customer due diligence (CDD), and risk assessment, tailored to evolving AML regulations. Advanced analytics and machine learning capabilities are crucial for detecting and analyzing suspicious activities, enhancing the accuracy and efficiency of AML processes.

The software should have an intuitive interface and robust support to ensure it can be easily operated by compliance teams, regardless of their technical expertise. This user-friendliness is crucial for day-to-day operations and for ensuring that all compliance measures are consistently and effectively implemented. Scalability and customization are additional important

Overall, selecting the right AML compliance software involves balancing technological sophistication, ease of use, and adaptability to regulatory changes.

What AML Solutions Exist?

The largest companies offering AML compliance software solutions are recognized for their advanced capabilities and extensive reach in the AML software market.

LexisNexis is known for its comprehensive risk solutions and extensive database that aids in risk management and AML compliance. ComplyAdvantage stands out for its use of machine learning and AI in customer screening and transaction risk management. NICE Actimize is notable for its AI and machine learning-infused AML solutions, providing a broad spectrum of financial crime risk management tools. Sanction Scanner is an established name in the RegTech space, focusing on customer and transaction screening with a comprehensive AML data set. Napier provides an end-to-end intelligent compliance platform using the latest AI and ML technology for transaction and client screening. Sumsub specializes in user and business verification and AML transaction monitoring, offering detailed risk profiling. SEON offers a range of AML solutions with a focus on digital footprint detection and real-time alerts. Ondato provides white label KYC checks, integrating seamlessly into various business models.

Kyros is an alternative to many of these systems, offering advanced technology, comprehensive data analysis, and flexible, scalable solutions tailored to diverse business needs.

Latest resources about KYC and AML

Read the latest on Kyros Anti-Money Laundering Software Suite and various KYC and AML topics.

What is AML and Why It Matters in 2025?

In an increasingly interconnected and digital world, the threat of financial crimes like money laundering continues to grow. Anti-Money Laundering...

AML/CFT Standards: Ensuring a Secure Financial Landscape

"The fight against money laundering and terrorist financing is a global responsibility that requires collaboration and commitment from all nations."-...

Regulatory Backstop

"The presence of a robust regulatory backstop is instrumental in fostering confidence in the financial system and preventing systemic failures."...

Customer Identification Program (CIP)

"The Customer Identification Program is not just a regulatory obligation; it is a critical tool in the fight against financial...

Ultimate Beneficial Ownership (UBO) Registry

he Ultimate Beneficial Ownership (UBO) Registry plays a crucial role in identifying the individuals who ultimately own or control a...

Non-Financial Businesses and Professions (NFBPs)

Non-Financial Businesses and Professions (NFBPs) encompass a wide range of industries and occupations that are vulnerable to money laundering and...

Want to Learn More?

Book a 20 minutes discovery call now.