White-Collar Crime

White-collar crime – a phrase you’ve probably heard before, and one that might even conjure up images of corporate moguls pilfering from the company coffers.

Written by Erling Andersen

Written by Erling Andersen

White-collar crime – a phrase you’ve probably heard before, and one that might even conjure up images of corporate moguls pilfering from the company coffers. But, what exactly is it, and why should you, as an individual or business, care about it? Read on as we unpack this complex concept and unravel the reasons why it’s more important to you than you might realize.

Definition: What is White-Collar Crime?

White-collar crime refers to non-violent criminal offenses, usually committed in commercial or business settings, by individuals or organizations. These are not the petty thieves of the alleyways; instead, these are crimes committed by people in suits, wielding power, authority, and often, a significant amount of trust. Often insidious in nature, these offenses are designed to deliver financial gain at the expense of others, the economy, or even entire societies.

Common examples of white-collar crimes include fraud, embezzlement, insider trading, and money laundering. Intricate and concealed beneath layers of legitimate business transactions, these crimes can have far-reaching effects, causing economic instability and eroding public trust in financial institutions.

Practical Example: A Tale from the Real World

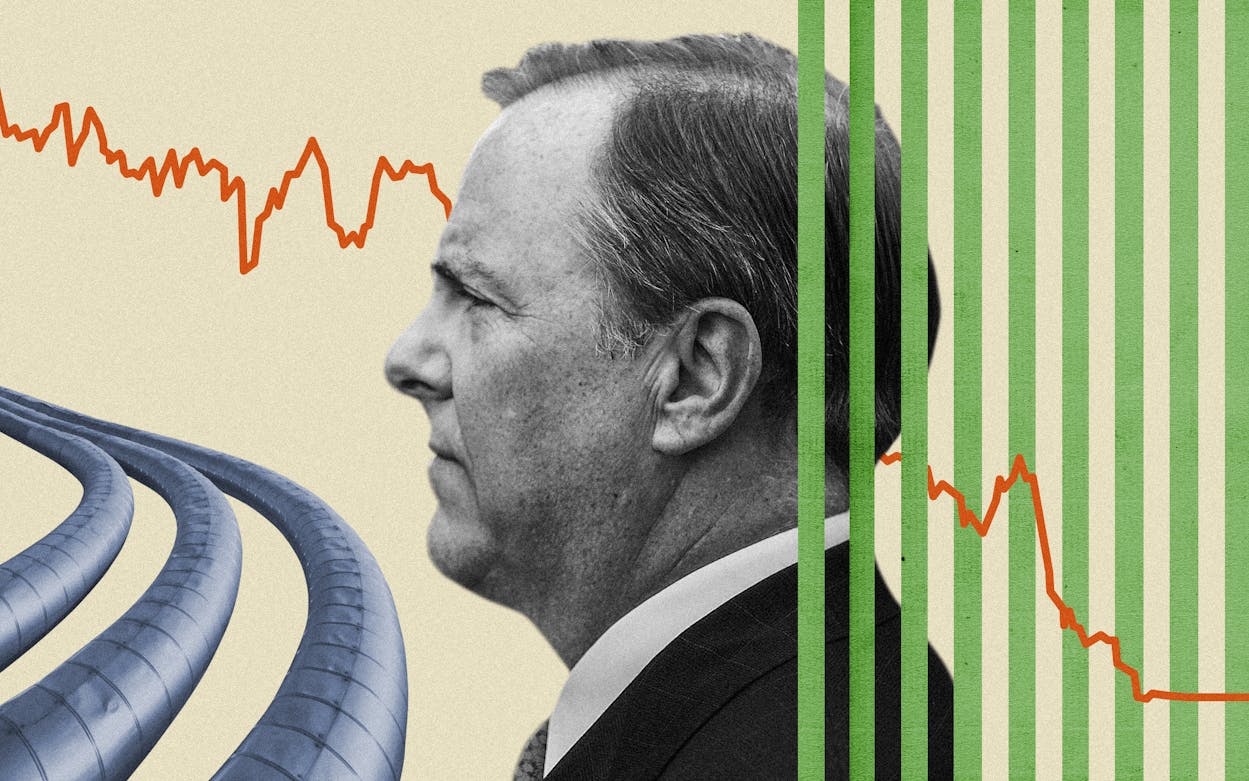

To really grasp the true impact of white-collar crime, it’s beneficial to consider a real-world example. One of the most notorious cases in history is that of the Enron scandal, a saga that rocked the corporate world in the early 2000s and continues to serve as a stark reminder of the potential devastation of unchecked financial fraud.

Enron, once hailed as the epitome of corporate success, was an American energy, commodities, and services company. Founded in 1985, the Houston-based corporation had stakes in industries as diverse as pulp and paper, power plants, and natural gas pipelines. By the year 2000, it had climbed the corporate ladder to become the seventh-largest company in the U.S., with reported revenues of around $101 billion.

However, beneath this façade of success, Enron’s top executives were orchestrating a vast accounting fraud. They employed a complex array of accounting loopholes, special purpose entities, and deliberately obscured financial reporting to hide billions of dollars in debt from failed deals and projects. Essentially, they were painting a rosy picture of the company’s financial health when, in reality, Enron was spiraling towards insolvency.

When this fraud came to light in 2001, the effects were cataclysmic. Enron filed for bankruptcy, wiping out $74 billion in stock market value and leading to the loss of thousands of jobs. Shareholders lost billions, retirement funds evaporated, and public faith in the corporate world took a massive hit.

The executives at the helm of this fraud were subsequently convicted. Enron’s CEO, Jeffrey Skilling, received a 24-year prison sentence, and its founder, Kenneth Lay, was convicted on six counts of fraud and conspiracy but died before sentencing.

The Enron scandal is a potent example of white-collar crime in action. It showcases how high-ranking individuals, clothed in the respectability of corporate positions, can orchestrate vast, complex frauds leading to devastating financial and societal consequences. The fallout of the Enron scandal is a testament to the need for robust, effective systems of detection, reporting, and enforcement in the fight against white-collar crime.

Statistics and Relevant Numbers: The Cold, Hard Facts

Numbers don’t lie, and in the realm of white-collar crime, the statistics and figures reveal a reality that is both startling and eye-opening. It’s essential to delve into these numbers to fully understand the magnitude of the problem and to recognize the urgency to act.

Let’s start with the United States, a country with a robust economy and complex financial ecosystem. Here, non-violent crimes such as fraud, embezzlement, and forgery account for staggering financial losses. To be more specific, the Federal Bureau of Investigation (FBI) reported that in 2020 alone, these types of white-collar crimes resulted in more than $12.7 billion in losses. This isn’t a mere drop in the ocean. To put it into perspective, consider this – with that sum of money, one could build around 25,000 average American homes or purchase over 2.5 million brand new mid-range cars. The scale of financial damage is indeed vast.

But that’s not all. The issue of white-collar crime isn’t confined within national boundaries; it’s a global menace. The United Nations Office on Drugs and Crime (UNODC) estimates that the sum of money laundered worldwide each year amounts to approximately 2-5% of the global Gross Domestic Product (GDP). Translated into current US dollars, this estimation ranges between $800 billion to a mind-boggling $2 trillion.

In simpler terms, the lower end of this range ($800 billion) is more than the entire GDP of countries like the Netherlands or Turkey. And at the higher end ($2 trillion), the amount surpasses the annual GDP of countries like Italy or Brazil. That’s the scale at which money is illicitly circulating in the global economy, distorting markets, aiding criminal enterprises, and undermining legitimate economic growth.

These statistics underscore the vast scale and pernicious impact of white-collar crime. It is a reality we must face and combat head-on to ensure the stability of our global financial systems and the integrity of our societies. Effective solutions require a multi-faceted approach, combining stringent regulations, robust detection and enforcement mechanisms, and a consistent commitment to ethical business practices.

Conclusion: Unmasking the Invisible Thief

As we draw the curtains on our in-depth exploration of white-collar crime, we realize that it’s more than just a phrase or a distant issue. It’s an insidious, real-world problem that weaves its way through the tapestry of our society and economy, leaving a trail of damage in its wake.

White-collar crime isn’t a faceless monster lurking in the shadowy alleys of the business world. It’s a crime orchestrated by individuals who, in many cases, are respected members of society, dressed in suits, and working from the comfort of corporate boardrooms. This form of crime, hidden behind the veneer of legitimacy, isn’t bound by geography or industry. It infiltrates the global economy, causing ripples that affect businesses, investors, employees, and consumers alike.

Understanding the definition and recognizing the prevalence of white-collar crime is only the first step in our collective battle against it. Knowledge, while essential, isn’t sufficient. We need to follow through with proactive steps to detect, prevent, and combat these financial crimes. For businesses, this translates into implementing robust internal controls, fostering a culture of integrity, and ensuring compliance with regulatory norms.

In the face of staggering statistics and the well-known examples of corporate fraud, one may feel overwhelmed. The numbers we’ve discussed are massive, and the impact of these crimes, as seen in cases like Enron, can be devastating. Yet, it’s important to remember that every problem, no matter how significant, presents an opportunity for solutions and improvements. The story of white-collar crime is no different.

For every case of fraud or embezzlement, there is a chance to learn, to strengthen our systems, and to build a corporate culture that values transparency and integrity over short-term gain. We have the opportunity to leverage technology to enhance our capabilities in detecting and preventing these crimes. The advent of sophisticated software like the Kyros AML Data Suite equips us with tools to fortify our defenses against financial fraud.

In the face of white-collar crime, we must choose not to be passive spectators but to be active participants in combating it. Let’s remember that the fight against white-collar crime is not a solitary battle waged by law enforcement agencies or a handful of corporate compliance officers. It’s a collective endeavor that involves all stakeholders in the business world – from top executives to the newest employees, from large corporations to small businesses, from regulators to the customers themselves.

The fight against white-collar crime is indeed our fight. We are all involved, and we all stand to gain from a business world where trust, transparency, and fairness are the guiding principles. Let’s strive to unmask the invisible thief, shining a light on the hidden corners of financial fraud, and work together to make our economy safer, fairer, and more resilient.

So, how do we do that? Here’s where Kyros AML Data Suite steps into the picture.

Kyros AML Data Suite: Your Shield Against Financial Fraud

When it comes to combating white-collar crimes like money laundering, a proactive approach is the best defense. That’s where Kyros AML Data Suite comes into play. This state-of-the-art SaaS software provides you with a comprehensive set of tools designed to ensure you remain compliant with Anti-Money Laundering (AML) regulations.

Imagine having a digital sentinel, tirelessly scanning transactions for suspicious patterns, analyzing data in real-time, and providing actionable insights to help you make informed decisions. That’s exactly what Kyros AML Data Suite does.

What’s more, this software comes equipped with machine learning capabilities, enabling it to evolve with the ever-changing landscape of financial crime. It’s not just reactive; it’s predictive. With Kyros, you’re not just plugging holes; you’re fortifying your fortress against future attacks.

The reality of white-collar crime might be daunting, but the solution doesn’t have to be. With Kyros AML Data Suite, you’ll have a robust system of defense. After all, in the world of white-collar crime, knowledge is power, vigilance is key, and the right tool can make all the difference. Are you ready to turn the tables on financial fraud?

Share article on