Resources

Politically Exposed Entities (PEEs)

Politically Exposed Entities (PEEs) refer to individuals who hold prominent public positions or have close associations with...

International Organization of Securities Commissions

Explore the comprehensive work of the International Organization of Securities Commissions (IOSCO) in enhancing investor protection and...

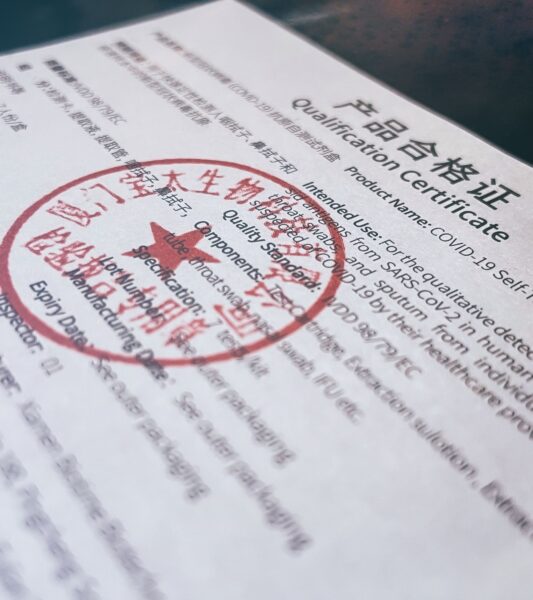

Certificate of Compliance

Understand the significance of certificate of compliance and its role in ensuring adherence to regulatory requirements.

6th Anti-Money Laundering Directive (6AMLD)

Dive into our comprehensive dictionary guide on the 6th Anti-Money Laundering Directive (6AMLD). Discover the key aspects,...

Compliance Reporting in AML

Discover how compliance reporting strengthens AML processes and safeguards financial systems. Explore the key components, best practices,...

Third-Party Verification in AML

Enhancing AML Compliance with Third-Party Verification - Discover the role of Third-Party Verification in AML compliance. From...

Enterprise-Wide Risk Assessment

Enterprise-Wide Risk Assessment (EWRA) is a comprehensive process carried out by an organization to identify, assess, and...

Targeted Financial Sanctions (TFS)

Targeted Financial Sanctions (TFS) refer to measures imposed by governments and international bodies to restrict or prohibit...

Banking Secrecy

Banking secrecy refers to the practice of protecting the confidentiality and privacy of customer information held by...

Reputational Risk (AML)

Reputational risk, in the context of Anti-Money Laundering (AML), refers to the potential harm to an organization's...