Resources

Compliance Risk

Compliance risk refers to the potential for an organization to violate laws, regulations, industry standards, or internal...

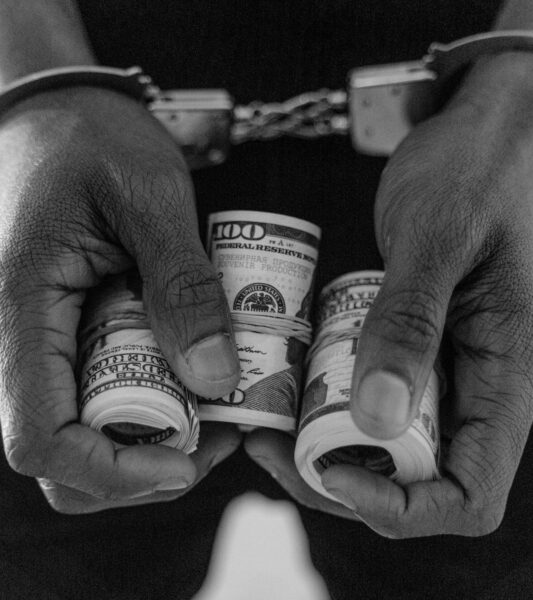

Money Laundering Stages: Placement, Layering, Integration

Money laundering is a process through which illegally obtained funds made to appear legitimate by disguising their...

AML Audit

An AML audit refers to a comprehensive assessment and evaluation of an organization's Anti-Money Laundering (AML) program...

Bank Secrecy Act (BSA)

The Bank Secrecy Act (BSA) is a federal law enacted in the United States in 1970 that...

Currency Transaction Report (CTR)

When an individual or business deposits a significant amount of cash, typically above a specified threshold (currently...

Financial Crimes Enforcement Network (FinCEN)

"FinCEN and its counterparts around the globe must continue to cooperate and innovate together." -Sigal Mandelker

4th Anti-Money Laundering Directive (4AMLD)

"The 4th Anti-Money Laundering Directive (4AMLD) is a critical tool in the fight against money laundering and...

The Role of KYC in Achieving Sustainable AML Compliance

KYC (Know Your Customer) is essential for sustainable AML (Anti-Money Laundering) compliance, as it allows businesses to...

Big data analytics for AML compliance

Discover how big data is transforming AML compliance practices. From harnessing the potential of data analytics and...

Navigating the post-5AMLD AML compliance

Navigate the complexities of AML compliance in a post-5AMLD world with expert insights on strengthening customer due...