Resources

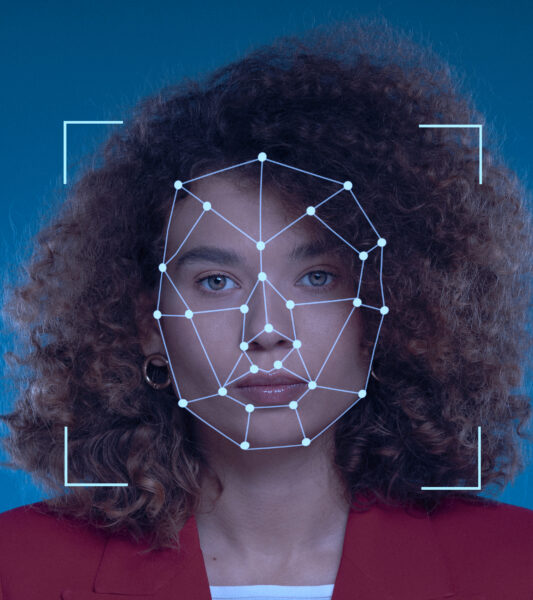

Risk Assessment

Risk Assessment is a systematic process used by financial institutions and businesses to identify, evaluate, and prioritize...

Ongoing Monitoring

Ongoing Monitoring is a critical component of anti-money laundering! (AML) and counter-terrorist financing (CTF) efforts, involving the...

High-Risk Customers

High-Risk Customers refer to individuals, entities, or customer groups that are deemed to have a higher potential...

Financial Intelligence Unit (FIU)

A Financial Intelligence Unit (FIU) is a specialized government agency responsible for collecting, analyzing, and disseminating financial...

Counter-Terrorist Financing (CTF)

Counter-Terrorist Financing (CTF) refers to the financial activities and measures implemented to prevent the funding of terrorist...

Compliance Risk

Compliance risk refers to the potential for an organization to violate laws, regulations, industry standards, or internal...

The Role of KYC and AML Regulations in Preventing Financial Fraud

Together, AML regulations and KYC procedures form the first line of defense against financial fraud. As we...

Practical Guide to Implementing the EU Travel Rule Regulation

The EU Travel Rule has emerged as a key aspect of the EU's commitment to combat money...

Money Laundering Stages: Placement, Layering, Integration

Money laundering is a process through which illegally obtained funds made to appear legitimate by disguising their...

AML Audit

An AML audit refers to a comprehensive assessment and evaluation of an organization's Anti-Money Laundering (AML) program...