Resources

Inherent Risk

Inherent risk refers to the level of risk inherent in a business or industry that can potentially...

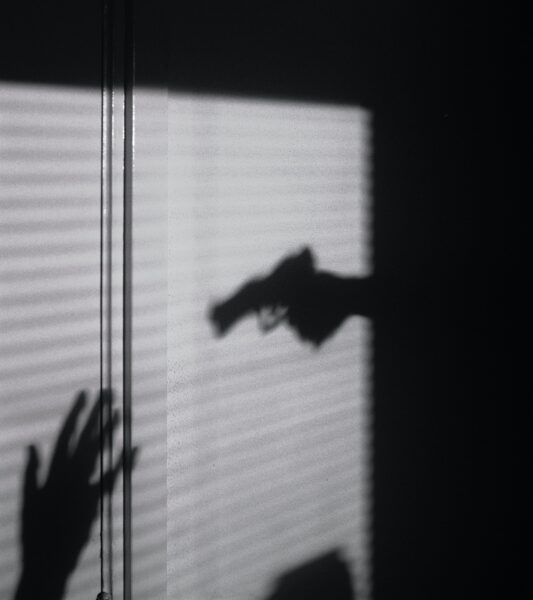

Cultural Property Crime (CPC)

Discover the dark underworld of cultural property crime (CPC) and the ongoing battle to protect our global...

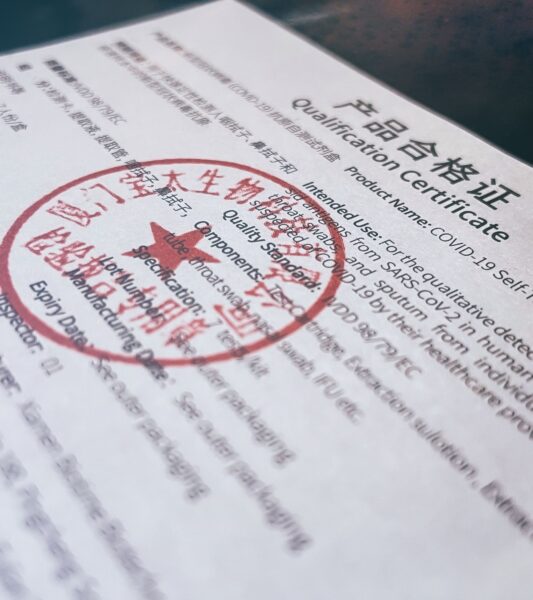

Certificate of Compliance

Understand the significance of certificate of compliance and its role in ensuring adherence to regulatory requirements.

Cash Intensive Businesses

Discover the intricacies of cash intensive businesses and the risks they face in our brief guide.

6th Anti-Money Laundering Directive (6AMLD)

Dive into our comprehensive dictionary guide on the 6th Anti-Money Laundering Directive (6AMLD). Discover the key aspects,...

Money Laundering Risk Indicator (MLRI)

Discover how the Money Laundering Risk Indicator (MLRI) enhances risk assessment, resource allocation, compliance, and detection of...

Intra-group Transfers in AML

Managing intra-group transfers in AML requires a comprehensive approach. Delve into the complexities of risk assessment, enhanced...

Exposed Person Lists (EPL)

Enhance your AML compliance practices with Exposed Person Lists (EPLs). Dive into the world of risk assessment,...

Compliance Risk Matrix: AML Professional Guide

In the dynamic world of Anti-Money Laundering (AML) regulations, staying ahead of compliance risks is crucial for...

How to Develop an Effective AML Compliance Program

Developing an effective AML compliance program is a complex but crucial task. It's not just about ticking...