Resources

Correspondent Banking Relationships

Delve into the world of correspondent banking relationships and their crucial role in facilitating cross-border transactions.

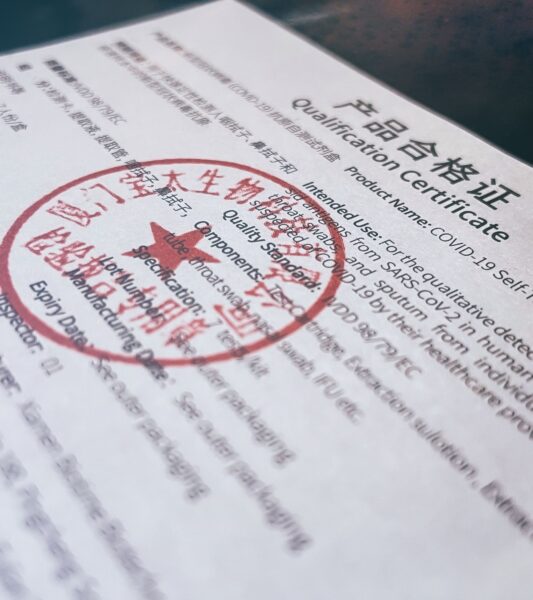

Certificate of Compliance

Understand the significance of certificate of compliance and its role in ensuring adherence to regulatory requirements.

FinCEN Files in AML

Delve into the captivating world of money laundering as the FinCEN Files expose the intricate web of...

Step-by-Step Guide to AML Risk Assessment

In the world of finance and business, the term 'AML Risk Assessment' is more than just a...

Financial Information Sharing Partnerships (FISPs)

Step into the world of Financial Information Sharing Partnerships (FISPs) and harness the power of collaborative information...

Exposed Person Lists (EPL)

Enhance your AML compliance practices with Exposed Person Lists (EPLs). Dive into the world of risk assessment,...

Unexplained Wealth Orders (UWOs)

Dive into the realm of Unexplained Wealth Orders (UWOs), a powerful tool in the global fight against...

Currency Transaction Reports (CTRs)

Uncover the significance of Currency Transaction Reports (CTRs) for AML professionals. Dive into the purpose, reporting thresholds,...

Compliance Risk Matrix: AML Professional Guide

In the dynamic world of Anti-Money Laundering (AML) regulations, staying ahead of compliance risks is crucial for...

International Compliance Association (ICA)

In this edition, we will delve into the International Compliance Association (ICA), its definition, practical examples, statistics,...