Resources

Record Keeping Requirements

Record keeping requirements refer to the regulatory obligations imposed on businesses and financial institutions to maintain accurate,...

De-risking

De-risking refers to the strategic decision made by financial institutions to reduce or eliminate relationships with customers,...

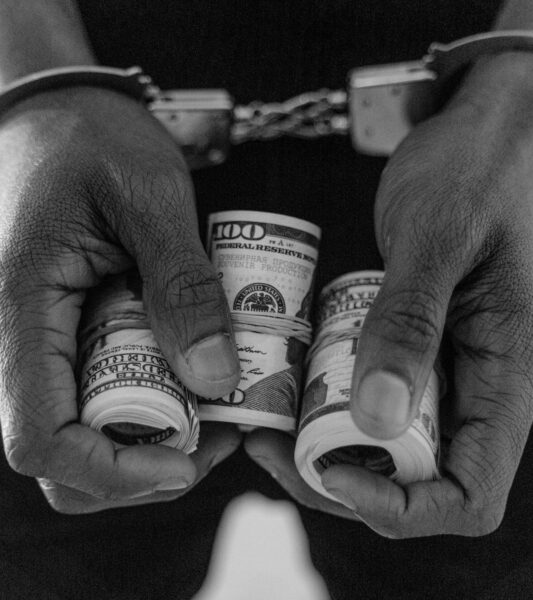

Structuring Transactions

Structuring transactions, also known as smurfing or money structuring, refers to the practice of intentionally breaking down...

Identity Verification

Identity verification refers to the process of verifying the identity of individuals or entities to ensure they...

Financial Sanctions

Financial sanctions are measures imposed by governments, regulatory bodies, or international organizations to restrict or prohibit financial...

Transaction Limit

Transaction limits refer to the predetermined maximum amounts or volume of financial transactions that individuals or entities...

Currency Transaction Report (CTR)

When an individual or business deposits a significant amount of cash, typically above a specified threshold (currently...

A Guide to KYC and AML Policies

Explore the importance of international AML cooperation and information sharing in combating money laundering. Understand the collaborative...

Risk-Based Approach (RBA)

"By embracing a risk-based approach, organizations can better align their resources with the most significant threats, making...

Financial Action Task Force (FATF)

"The fight against money laundering and terrorist financing is a shared responsibility." - FATF