Resources

AML/CFT Standards: Ensuring a Secure Financial Landscape

"The fight against money laundering and terrorist financing is a global responsibility that requires collaboration and commitment...

Regulatory Backstop

"The presence of a robust regulatory backstop is instrumental in fostering confidence in the financial system and...

Customer Identification Program (CIP)

"The Customer Identification Program is not just a regulatory obligation; it is a critical tool in the...

Non-Financial Businesses and Professions (NFBPs)

Non-Financial Businesses and Professions (NFBPs) encompass a wide range of industries and occupations that are vulnerable to...

Cash Thresholds

Cash thresholds play a critical role in identifying and reporting suspicious transactions to prevent money laundering and...

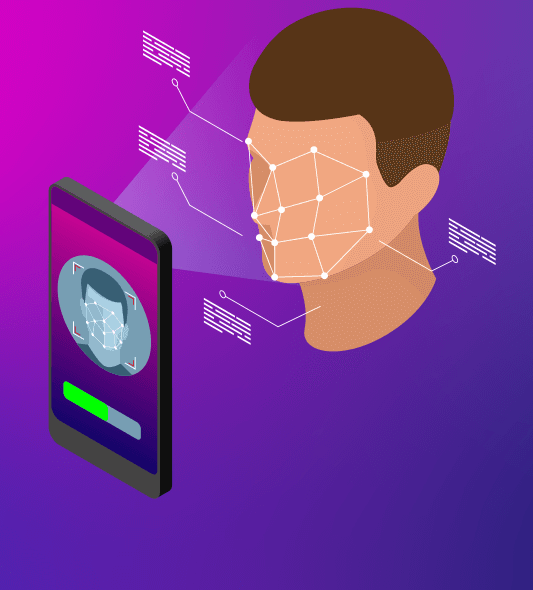

Customer Risk Assessment

Customer Risk Assessment is a crucial step in ensuring compliance with anti-money laundering (AML) regulations. This article...

Best Practices for AML Transaction Monitoring

Discover the best practices for AML transaction monitoring to mitigate risks, identify red flags, and avoid penalties....

Office of Foreign Assets Control (OFAC)

The Office of Foreign Assets Control (OFAC) wields a significant influence over global financial transactions, which is...

The Essential Role of Due Diligence in AML Compliance

One of the fundamental components of AML compliance is due diligence. This article explores the essential role...

Interpol’s Role in Combating Money Laundering

Join us as we delve into Interpol's dedicated efforts to combat money laundering. Explore their partnerships, capacity...