Resources

AML/CFT Standards: Ensuring a Secure Financial Landscape

"The fight against money laundering and terrorist financing is a global responsibility that requires collaboration and commitment...

Regulatory Backstop

"The presence of a robust regulatory backstop is instrumental in fostering confidence in the financial system and...

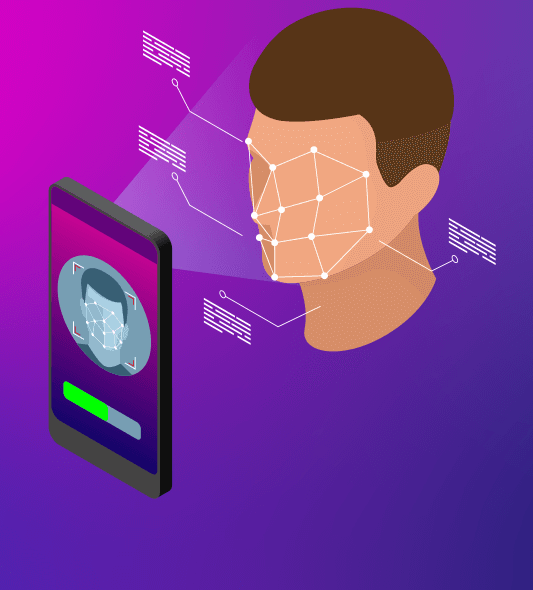

Customer Identification Program (CIP)

"The Customer Identification Program is not just a regulatory obligation; it is a critical tool in the...

Front Companies

Front companies serve as a deceptive facade for illicit activities, allowing individuals or organizations to conceal their...

Suspicious Transaction Indicators

Suspicious transaction indicators play a crucial role in AML efforts by providing red flags that suggest potential...

Customer Profiling

Customer profiling is a critical component of AML compliance, enabling financial institutions to assess the risk associated...

Cash Thresholds

Cash thresholds play a critical role in identifying and reporting suspicious transactions to prevent money laundering and...

Customer Risk Assessment

Customer Risk Assessment is a crucial step in ensuring compliance with anti-money laundering (AML) regulations. This article...

Pooled Accounts

Pooled accounts are financial arrangements where multiple individuals or entities combine their funds into a single account....

Best Practices for AML Transaction Monitoring

Discover the best practices for AML transaction monitoring to mitigate risks, identify red flags, and avoid penalties....