Resources

Navigating the post-5AMLD AML compliance

Navigate the complexities of AML compliance in a post-5AMLD world with expert insights on strengthening customer due...

Payment Service Providers in EU Travel Rule

Ensuring AML Compliance in the Era of the EU Travel Rule: Stay ahead of the regulatory curve...

Politically Exposed Persons (PEPs)

To effectively manage the risks posed by Politically Exposed Persons (PEPs) and ensure compliance with regulatory requirements,...

Enhanced Due Diligence (EDD)

"EDD is an essential component of a comprehensive AML program, enabling financial institutions to have a deeper...

Customer Due Diligence (CDD)

Customer Due Diligence (CDD) refers to the process of gathering and verifying relevant information about customers to...

Know Your Customer (KYC)

Know Your Customer (KYC) is a crucial process for financial institutions and regulated entities to verify the...

Anti-Money Laundering (AML)

"Money laundering undermines the integrity of our financial system and threatens our security. We must act collectively...

5AMLD: Implications and Opportunities for Fin-tech Companies

The Fifth Anti-Money Laundering Directive (5AMLD) introduced by the European Union strengthens the regulatory framework to combat...

Navigating the Complexities of KYC and AML Compliance in the Digital Era

The digital Era presents both opportunities and challenges for KYC and AML compliance. AML professionals must stay...

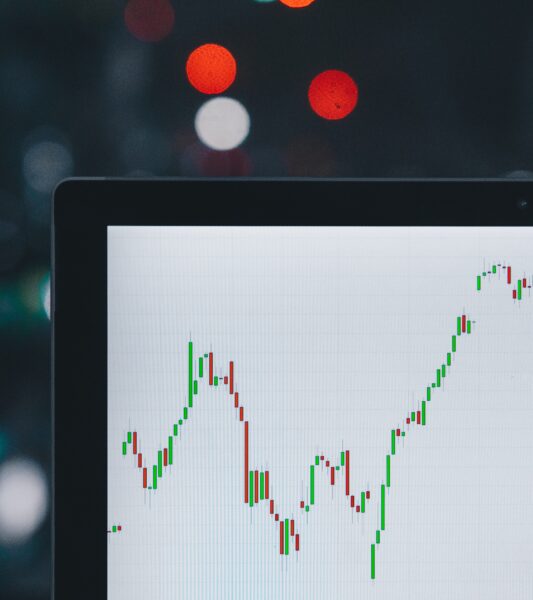

What to Look For in a AML Transaction Monitoring System

In the context of anti-money laundering (AML), a Transaction Monitoring System (TMS) is a software tool or...