False Documentation

False documentation refers to the creation, alteration, or use of counterfeit, forged, or fraudulent documents in financial transactions to deceive or mislead authorities, institutions, or individuals.

Written by Erling Andersen

Written by Erling Andersen

Definition: False documentation is a critical issue within Anti-Money Laundering (AML) compliance, enabling illicit activities such as money laundering, fraud, and corruption. It refers to the creation, alteration, or use of fraudulent or falsified documents to deceive authorities, institutions, or individuals.

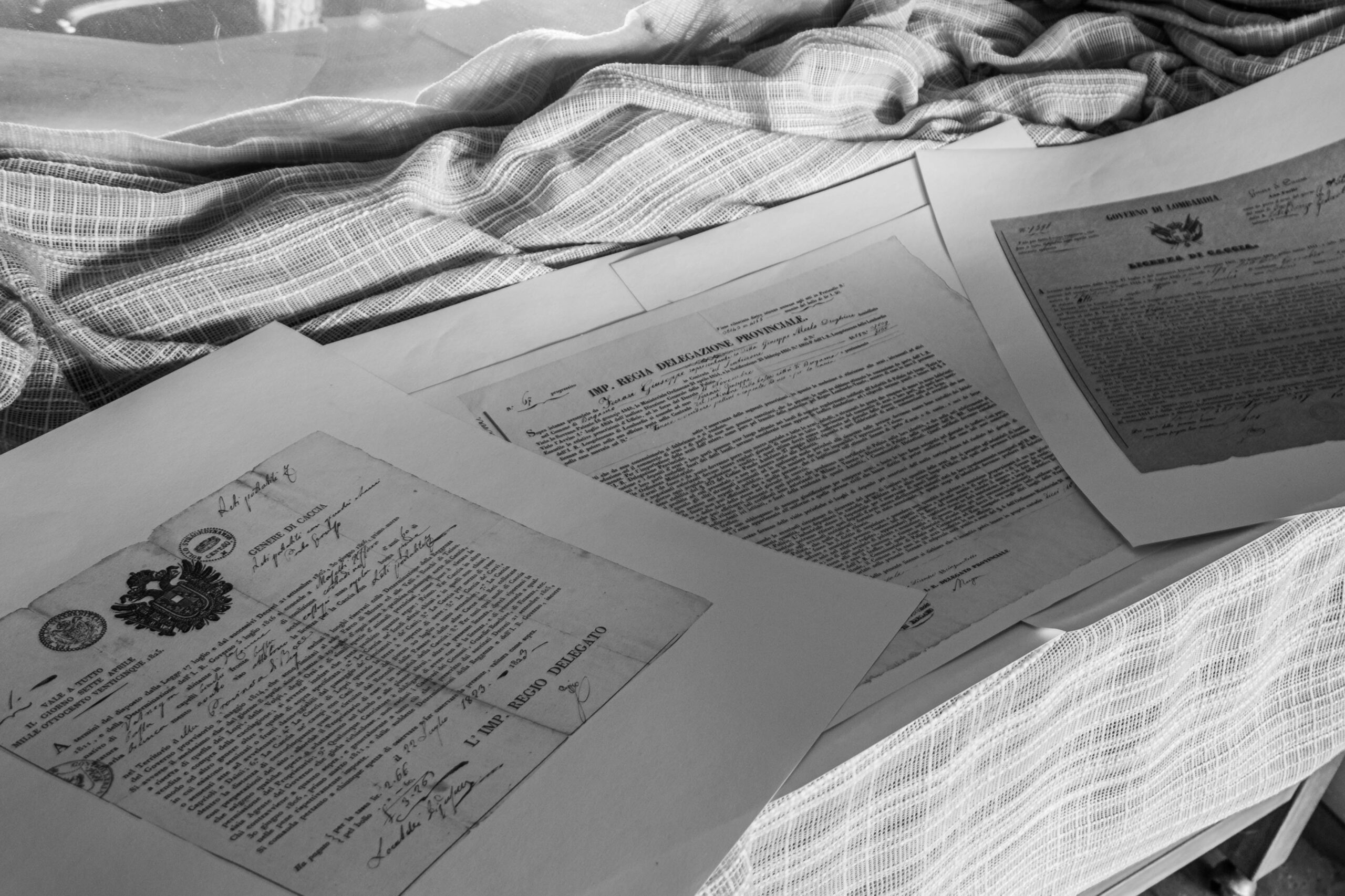

Historical View

“The history of the world is the history of a few documents.” – Thomas Carlyle

The use of false documentation to facilitate illicit activities dates back centuries. In ancient times, forgers crafted counterfeit seals. Also signatures, and documents to deceive authorities and gain unauthorized privileges. As societies progressed, so did the sophistication of document forgery techniques.

In the modern era, false documentation has played a significant role in high-profile scandals and criminal activities. The emergence of digital technology has both challenged and enabled document fraud, making it easier to create convincing counterfeit documents while also providing opportunities for advanced detection and prevention.

Throughout history, authorities, financial institutions, and regulators have continuously adapted their approaches to combat false documentation, leading to the development of robust AML compliance frameworks.

Practical Examples

“Forgery is the art of truth by other means.” – Edgar Degas

False documentation manifests in various forms across different sectors and illicit activities. Here are ten practical examples of false documentation:

- Falsifying identification documents, such as passports, driver’s licenses, or birth certificates.

- Forging financial statements, tax records, or business licenses to manipulate financial data.

- Creating counterfeit invoices or receipts to launder money or evade taxes.

- Generating fake employment records or pay stubs to secure loans or other financial benefits.

- Altering property ownership documents or titles to facilitate fraudulent real estate transactions.

- Fabricating medical records or prescriptions to engage in prescription drug abuse or insurance fraud.

- Producing counterfeit academic credentials, diplomas, or degrees to gain employment or qualifications fraudulently.

- Counterfeiting import or export documentation to evade customs duties or smuggle illicit goods.

- Manipulating shipping documents, such as bills of lading, to facilitate trade-based money laundering.

- Creating fictitious identities or shell companies with falsified corporate documents to conceal illicit activities.

These practical examples demonstrate the diverse ways in which false documentation can be employed to deceive and circumvent legal and regulatory frameworks.

Statistics

“Facts are stubborn things, but statistics are pliable.” – Mark Twain

Understanding the prevalence and impact of false documentation is essential for building effective AML compliance measures. Here are some key statistics related to document fraud:

- The Financial Action Task Force (FATF) estimates that money laundering is between 2% and 5% of global GDP, with false documentation playing a significant role.

- In 2020, the United Nations Office on Drugs and Crime (UNODC) reported that over 40% of high-level corruption cases involved the use of false documentation.

- The Association of Certified Anti-Money Laundering Specialists (ACAMS) found that 50% of financial institutions identified document fraud as a significant vulnerability in their AML programs.

- According to Europol, the number of counterfeit euros seized in the European Union reached over 1 million in 2020.

- A study conducted by LexisNexis Risk Solutions revealed that the average cost of a fraud case involving false documentation for businesses was approximately $3.6 million in 2020.

- The World Health Organization (WHO) estimates that up to 10% of pharmaceutical products worldwide are counterfeit, often supported by falsified documents.

- In a survey by the Ponemon Institute, 63% of organizations reported experiencing at least one instance of document fraud in the past two years.

- Research conducted by the Anti-Counterfeiting Collaborative found that the global trade in counterfeit and pirated goods reached $509 billion in 2020.

- The Insurance Information Institute (III) estimated that insurance fraud, including false documentation, costs insurers over $40 billion annually in the United States alone.

- According to Interpol, document fraud is a common enabler for human trafficking. Also terrorist financing, and other transnational organized crimes.

These statistics underscore the magnitude of the problem and emphasize the need for robust measures to detect and prevent false documentation in AML compliance efforts.

Incidents

“History doesn’t repeat itself, but it does rhyme.” – Mark Twain

Instances of false documentation impacting organizations. Also governments, and individuals have been widespread. Here are ten notable incidents:

- The Panama Papers leak in 2016 exposed how offshore entities were created using falsified documents to facilitate tax evasion and money laundering.

- The Enron scandal in the early 2000s revealed the use of false financial statements and documents to inflate profits and deceive investors.

- The Bernie Madoff Ponzi scheme involved falsified investment statements and documents to mislead investors, resulting in significant financial losses.

- The FIFA corruption scandal in 2015 exposed the use of false documentation, including invoices and contracts, to facilitate bribes and kickbacks.

- The Wells Fargo account fraud scandal involved the creation of unauthorized accounts using false customer documents to meet sales targets.

- The Wirecard scandal in 2020 revealed the fabrication of financial statements and documents to inflate the company’s assets and revenues.

- The Volkswagen emission scandal involved the use of false documentation to manipulate emission test results and deceive regulators.

- The Lehman Brothers bankruptcy in 2008 exposed the misclassification of assets and the use of false documentation to hide the extent of financial risk.

- The identity theft case of Frank Abagnale, portrayed in the film “Catch Me If You Can,” highlighted the use of false identification documents to commit fraud.

- The Operation Varsity Blues college admissions scandal in 2019 involved the creation of false academic records and documents to secure admissions through bribes.

These incidents demonstrate the real-world consequences of false documentation and the urgent need for effective AML compliance measures to prevent such occurrences.

The Future

“The future belongs to those who prepare for it today.” – Malcolm X

The fight against false documentation will continue to evolve as technology advances and criminal methods become more sophisticated. Here are ten areas that will shape the future of combating false documentation:

- The development of blockchain-based document verification systems to enhance transparency and ensure document integrity.

- The use of artificial intelligence and machine learning algorithms to detect patterns and anomalies in document-related transactions.

- The implementation of biometric authentication technologies to enhance the verification of identity documents.

- The emergence of digital identity solutions that rely on secure and tamper-proof documents stored on decentralized platforms.

- The collaboration between governments. Also financial institutions, and technology providers to establish standardized digital document formats.

- The integration of advanced optical and digital security features into physical documents to prevent counterfeiting.

- The adoption of distributed ledger technology for document sharing and verification, enabling secure and auditable document trails.

- The expansion of regulatory frameworks and international cooperation to address cross-border document fraud effectively.

- The investment in education and awareness programs to equip individuals and organizations with knowledge to identify and report false documentation.

- The continuous improvement of data analytics capabilities to detect and investigate suspicious document-related activities.

The future of combating false documentation holds great potential, but it also presents new challenges. Organizations need comprehensive AML compliance solutions that leverage advanced technologies and data intelligence to stay ahead of evolving threats.

Kyros AML Data Suite

“The future of AML compliance lies in data-driven solutions.”

As the landscape of AML compliance evolves, organizations need powerful tools to detect and prevent false documentation. Kyros AML Data Suite is an industry-leading AML compliance SaaS software that offers comprehensive solutions to address the challenges posed by false documentation.

With its advanced data analytics capabilities, Kyros AML Data Suite can analyze vast amounts of data. Also identify patterns, and detect suspicious document-related activities. The platform leverages machine learning algorithms and artificial intelligence to continuously adapt to emerging threats and provide accurate risk assessments.

Kyros AML Data Suite offers a range of features, including:

- Automated document verification and authentication processes

- Real-time monitoring and alert generation for suspicious document-related activities

- Integration with existing systems and databases for seamless data exchange

- Comprehensive reporting and audit trail functionality

- Customizable risk scoring and rule-based configurations

By leveraging the power of Kyros AML Data Suite, organizations can enhance their AML compliance efforts, reduce false positives, and mitigate the risks associated with false documentation.

Explore the Power of Kyros AML Data Suite

To learn more about how Kyros AML Data Suite can revolutionize your AML compliance program and combat false documentation effectively, visit kyrosaml.com. Book a call with our experts to discover the many benefits this powerful AML compliance software offers.

Conclusion

In the battle against financial crime, false documentation remains a significant challenge for regulators, financial institutions, and businesses. By understanding the historical context, practical examples. Also relevant statistics, and notable incidents related to false documentation, organizations can strengthen their AML compliance efforts and protect themselves from the risks it poses.

The future of AML compliance will depend on robust measures, advanced technologies, and data-driven solutions. Kyros AML Data Suite stands at the forefront of this transformation, providing organizations with the tools they need to detect. Also prevent, and combat false documentation effectively.

Stay vigilant, adapt to emerging threats, and embrace innovative solutions to safeguard against the perils of false documentation in the ever-evolving landscape of financial crime.

Share article on