Resources

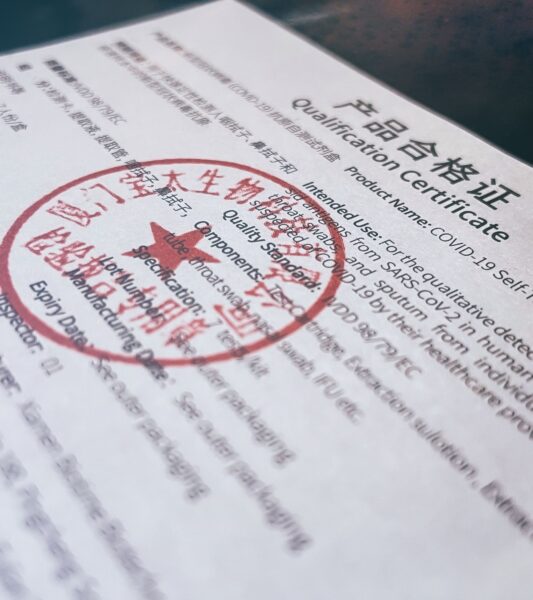

Certificate of Compliance

Understand the significance of certificate of compliance and its role in ensuring adherence to regulatory requirements.

Cash Intensive Businesses

Discover the intricacies of cash intensive businesses and the risks they face in our brief guide.

6th Anti-Money Laundering Directive (6AMLD)

Dive into our comprehensive dictionary guide on the 6th Anti-Money Laundering Directive (6AMLD). Discover the key aspects,...

Tax Haven in AML World

Tax havens: the hidden underworld of financial crimes. Join AML professionals as they dive into the characteristics...

Offshore Accounts in AML World

Offshore accounts pose unique challenges for AML professionals. Dive into this comprehensive guide to understand the risks...

Panama Papers

"The Panama Papers offer us a chance to change our system, to make it better." Joseph Stiglitz

Money Laundering Risk Indicator (MLRI)

Discover how the Money Laundering Risk Indicator (MLRI) enhances risk assessment, resource allocation, compliance, and detection of...

Intra-group Transfers in AML

Managing intra-group transfers in AML requires a comprehensive approach. Delve into the complexities of risk assessment, enhanced...

FinCEN Files in AML

Delve into the captivating world of money laundering as the FinCEN Files expose the intricate web of...

Risk Appetite Statement

In the complex world of Anti-Money Laundering (AML), managing risks is not a choice but a necessity....