What is AML and Why It Matters in 2025?

In an increasingly interconnected and digital world, the threat of financial crimes like money laundering continues to grow. Anti-Money Laundering (AML) compliance has become a critical pillar for businesses across industries. But what exactly is AML, and why does it matter more than ever in 2025? Let’s explore this crucial topic and understand how Kyros is leading the charge in simplifying and enhancing AML compliance.

Written by François Savard

Written by François Savard

What Is AML?

AML refers to a set of laws, regulations, and procedures designed to prevent criminals from disguising illegally obtained funds as legitimate income. It aims to:

- Detects and prevents financial crimes such as money laundering, fraud, and terrorist financing.

- Ensure transparency in financial transactions.

- Protect businesses and the global economy from the risks associated with illicit activities.

AML compliance involves various processes, including customer due diligence (CDD), transaction monitoring, risk assessment, and reporting suspicious activities to regulatory authorities.

Why AML Matters in 2025

1. The Rise of Digital Finance

The adoption of digital payment platforms, cryptocurrency, and decentralized finance (DeFi) has revolutionized how money moves globally. However, it has also created new avenues for bad actors to exploit loopholes. Robust AML measures are essential to safeguard these systems and maintain trust.

2. Evolving Regulations

Governments and international bodies have introduced stricter AML regulations to combat increasingly sophisticated financial crimes. In 2025, compliance with frameworks like the EU’s 6th Anti-Money Laundering Directive (6AMLD) is non-negotiable for businesses operating globally.

3. Financial and Reputational Risks

Failing to comply with AML requirements can result in hefty fines, operational disruptions, and irreparable damage to a company’s reputation. High-profile cases in recent years highlight the importance of proactive compliance.

4. Globalization of Business

As businesses expand internationally, they must navigate complex regulatory landscapes. Effective AML practices ensure seamless operations while minimizing risk.

Challenges in AML Compliance

Despite its importance, AML compliance can be challenging due to:

- Fragmented Systems: Many businesses rely on multiple, disconnected tools for compliance, leading to inefficiencies.

- Manual Processes: Traditional methods of onboarding and monitoring are time-consuming and error-prone.

- Rapidly Changing Regulations: Keeping up with global regulatory changes requires constant vigilance.

How Kyros Simplifies AML Compliance

Kyros is at the forefront of revolutionizing AML compliance with its cloud-based, all-in-one platform. Here’s how we address the challenges:

1. Unified Compliance Solution

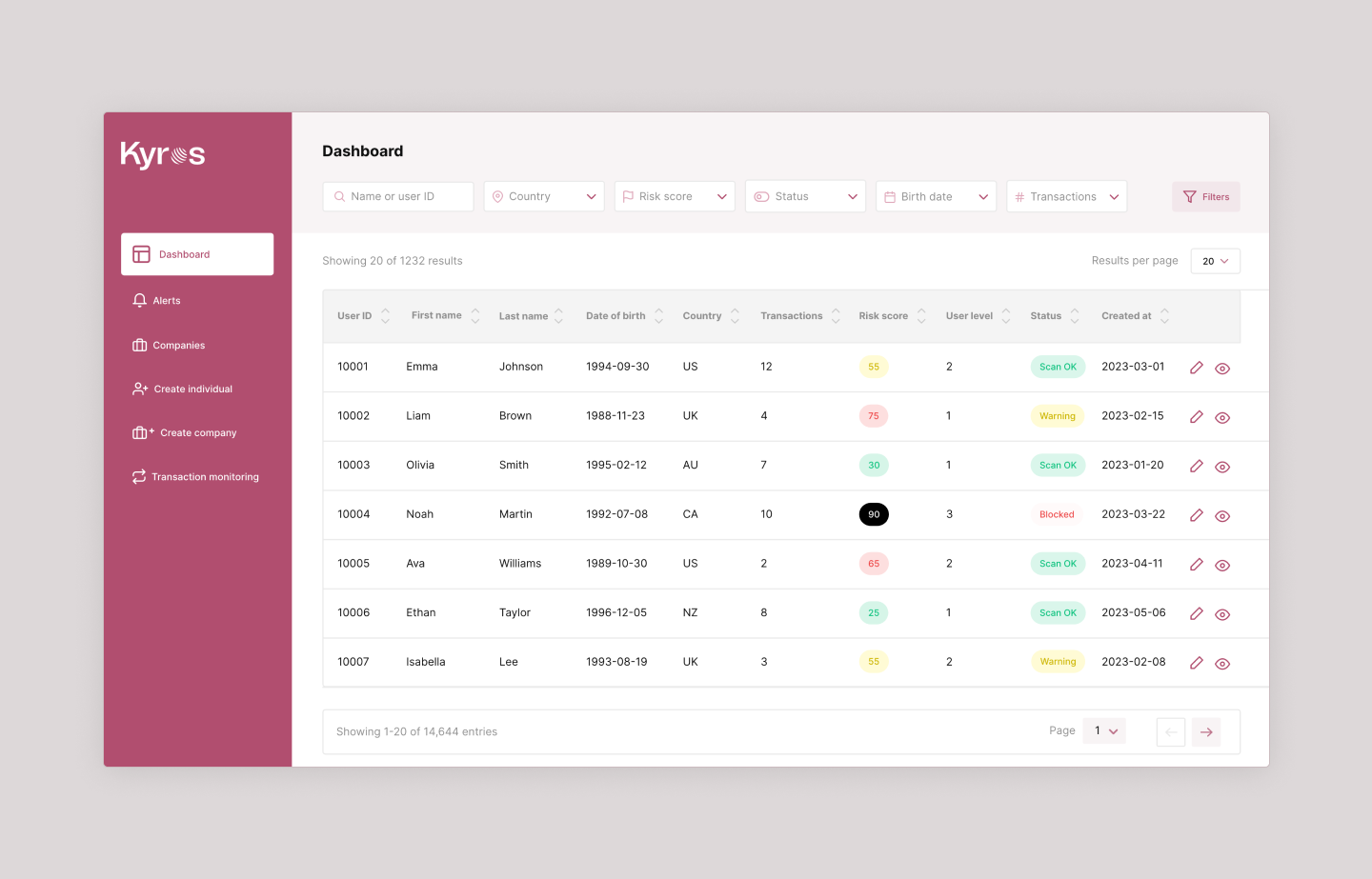

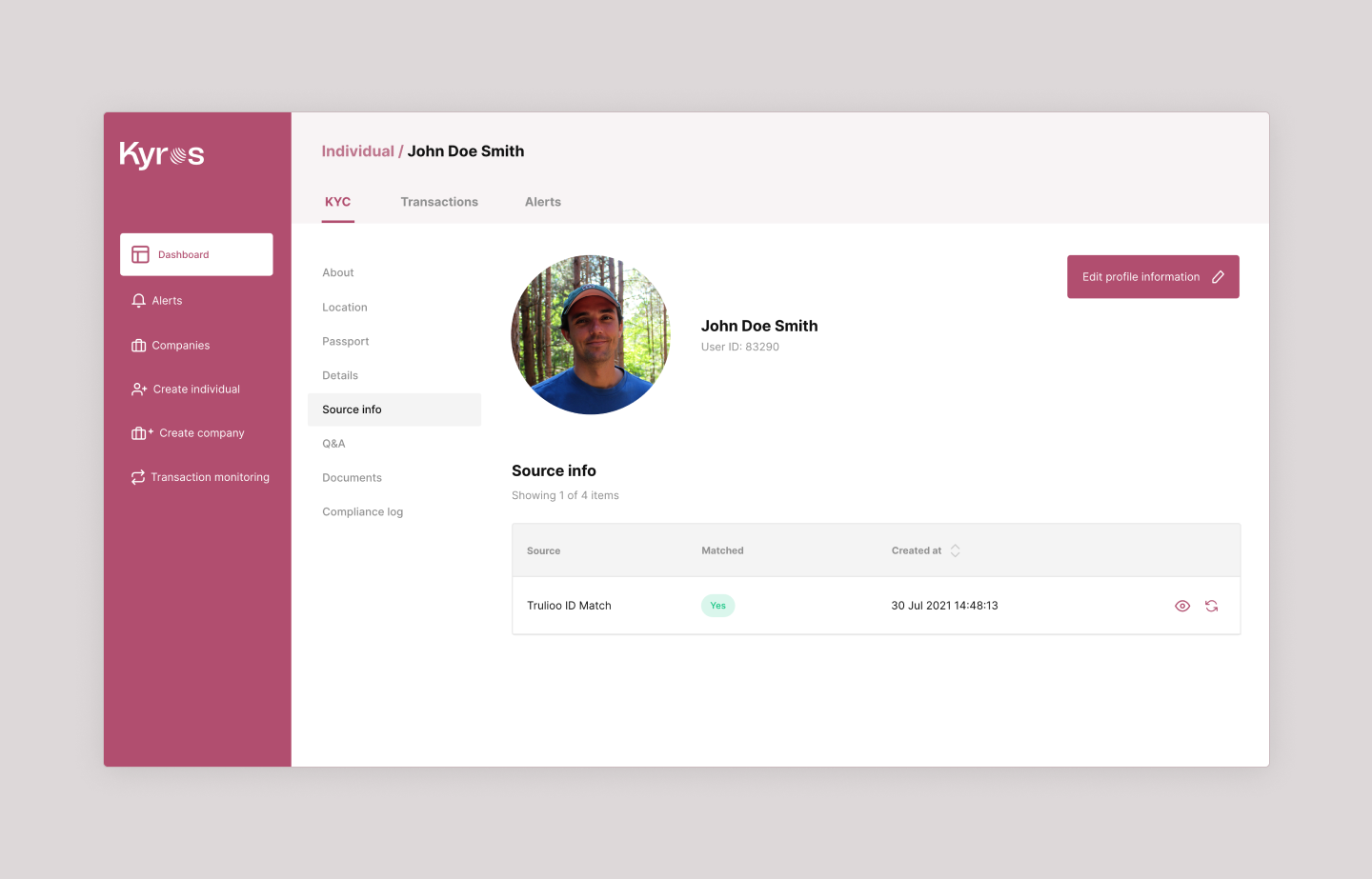

Our platform integrates all AML processes into a single dashboard, eliminating the need for multiple systems. From KYC (Know Your Customer) to transaction monitoring, Kyros provides a seamless experience.

2. Advanced Technology

Harnessing AI and machine learning, Kyros enables:

- Post-Facto transaction monitoring with threshold alerts.

- Automated risk scoring based on customizable factors.

- Enhanced detection of suspicious activities.

3. Global Coverage

Kyros supports compliance across over 100 countries, making it ideal for businesses with a global footprint. Our tools include comprehensive PEP (Politically Exposed Persons) and sanction checks, as well as adverse media screening.

4. Regulatory Expertise

Kyros’ dedicated compliance team stays ahead of regulatory changes, ensuring our platform evolves to meet new requirements. This allows businesses to focus on growth without worrying about compliance gaps.

Why Choose Kyros?

At Kyros, we believe AML compliance doesn’t have to be a burden. Our mission is to simplify compliance, empower businesses, and protect the global economy. With Kyros, you get:

- Cutting-Edge Technology: Stay ahead with tools designed for today’s challenges.

- Expertise You Can Trust: Leverage our deep industry knowledge to navigate complexities.

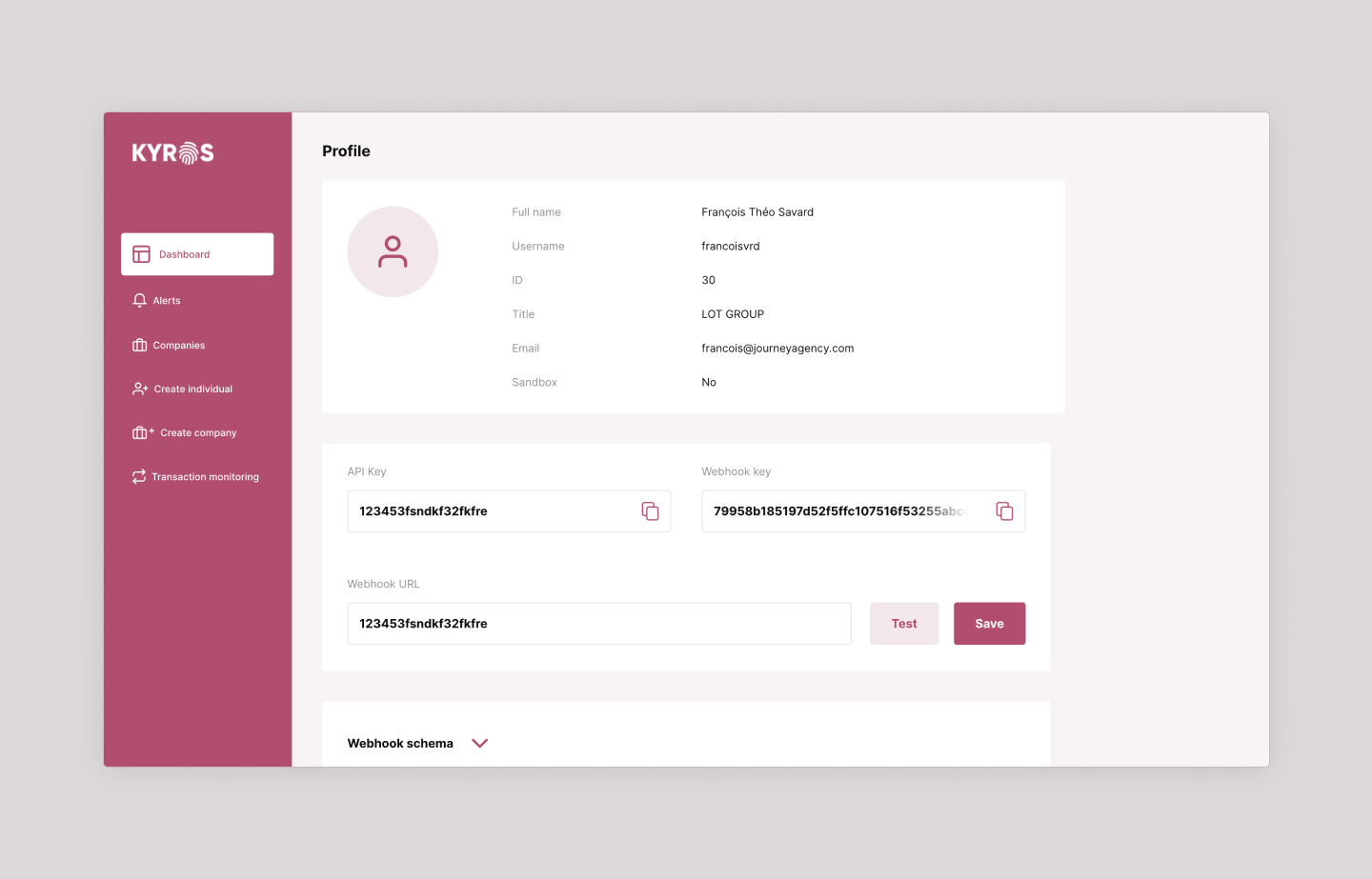

- Seamless Integration: Easily integrate Kyros with your existing systems through our robust API and Webhooks.

- Data Enrichment: Enrich your customer background checks with data enrichment for deeper insights and more robust risk assessments.

The Future of AML Compliance

As financial crimes evolve, so must our defenses. AML compliance in 2025 is no longer just a legal requirement—it’s a competitive advantage.

If you’re ready to simplify your AML compliance, reach out to Kyros today and experience the future of compliance solutions.

Share article on