Resources

AML/CFT Standards: Ensuring a Secure Financial Landscape

"The fight against money laundering and terrorist financing is a global responsibility that requires collaboration and commitment...

Regulatory Backstop

"The presence of a robust regulatory backstop is instrumental in fostering confidence in the financial system and...

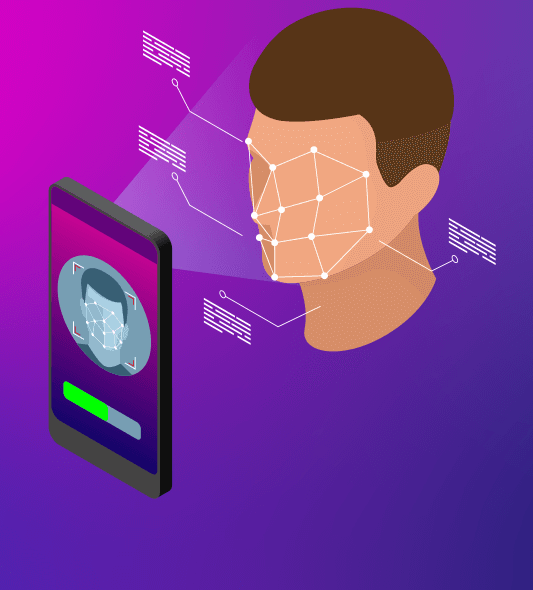

Customer Identification Program (CIP)

"The Customer Identification Program is not just a regulatory obligation; it is a critical tool in the...

Front Companies

Front companies serve as a deceptive facade for illicit activities, allowing individuals or organizations to conceal their...

Customer Profiling

Customer profiling is a critical component of AML compliance, enabling financial institutions to assess the risk associated...

Cash Thresholds

Cash thresholds play a critical role in identifying and reporting suspicious transactions to prevent money laundering and...

Best Practices for AML Transaction Monitoring

Discover the best practices for AML transaction monitoring to mitigate risks, identify red flags, and avoid penalties....

Joint Money Laundering Intelligence Taskforce (JMLIT)

In the fight against financial crimes, the Joint Money Laundering Intelligence Taskforce (JMLIT) has emerged as a...

Wolfsberg Group

Recognizing these challenges, the Wolfsberg Group stepped in to create the CBDDQ, a standardized questionnaire designed to...

White-Collar Crime

White-collar crime - a phrase you've probably heard before, and one that might even conjure up images...