Swiss Leaks

Swiss Leaks is the name of a large-scale investigation conducted by the International Consortium of Investigative Journalists (ICIJ) in collaboration with several news organizations around the world.

Written by Erling Andersen

Written by Erling Andersen

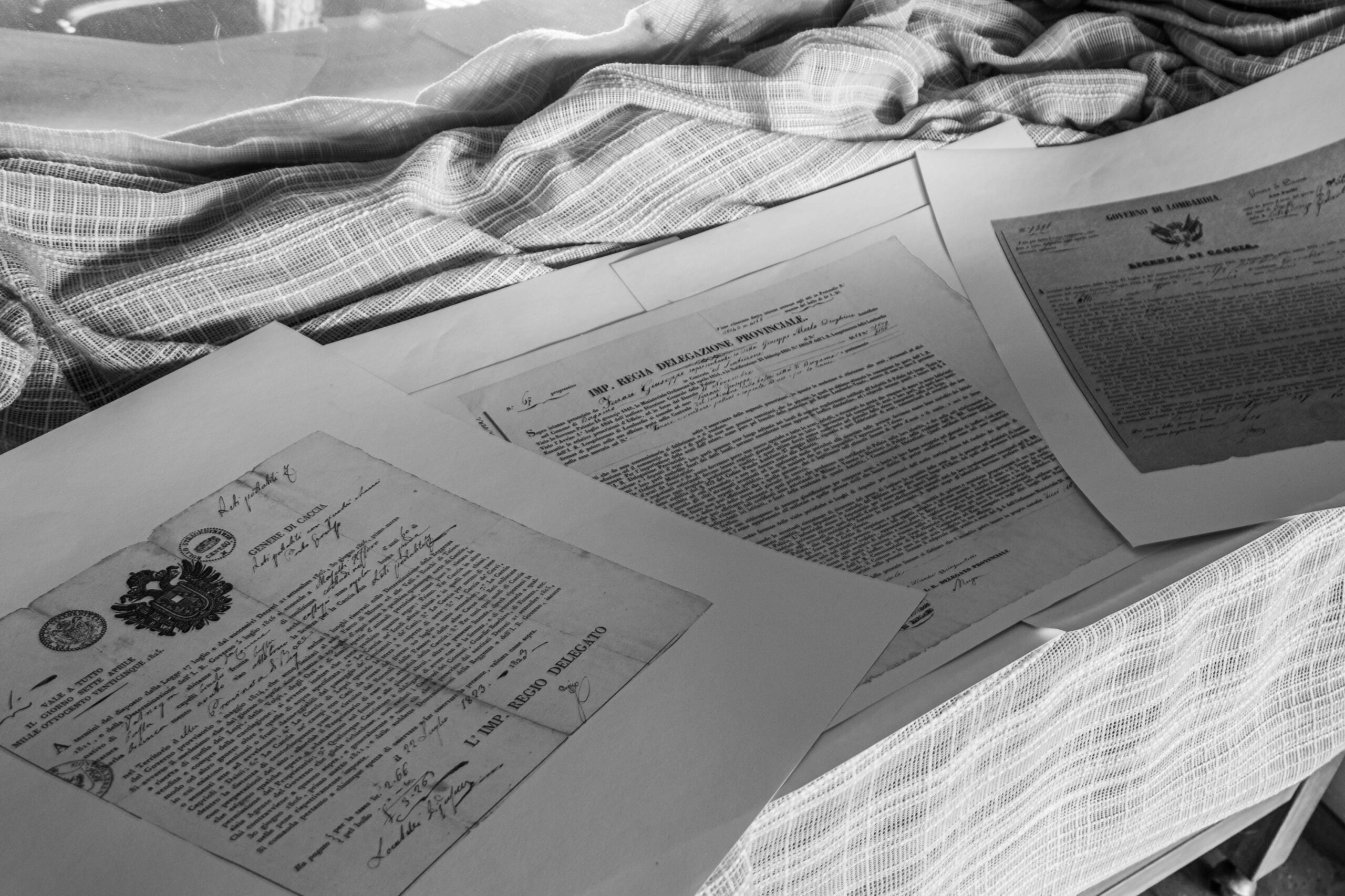

Swiss Leaks is the name of a large-scale investigation conducted by the International Consortium of Investigative Journalists (ICIJ) in collaboration with several news organizations around the world. The investigation was based on a trove of leaked documents from the Swiss branch of HSBC, one of the largest banks in the world.

The leaked documents, known as the Swiss Leaks, provided concrete evidence of individuals. It entities using offshore accounts, shell companies, and illicit transactions to conceal wealth and evade taxes. Wealthy individuals utilized Swiss bank accounts to hide their wealth and evade tax obligations in their home countries. The leaked documents revealed intricate offshore schemes and complex financial structures. It used to obscure the true beneficiaries of these transactions.

An HSBC Swiss employee leaked confidential bank documents in 2015. The International Consortium of Investigative Journalists (ICIJ) collaborated with news outlets to investigate the leak.

Dubbed Swiss Leaks, the documents revealed how offshore accounts, shell companies and complex transactions helped wealthy clients:

- Conceal assets

- Avoid taxes

- Evade reporting requirements in their home countries

The investigation published in February 2015.It revealed:

- At least 100,000 HSBC Swiss clients worth $100 billion were implicated

- 80% of accounts belonged to Europeans

- Data exposed links to politicians, celebrities and executives

The leak caused public outrage and calls for more bank regulation. Investigations and lawsuits targeted:

- HSBC bank for allegedly facilitating tax evasion and financial crimes

- Some high-net-worth clients for possible tax evasion

Swiss Leaks was part of a trend of leaks exposing the offshore finances of the wealthy and powerful, including:

- The Panama Papers leak of 11.5 million documents in 2016

- The Paradise Papers leak of 13.4 million documents in 2017

Definitions

HSBC

HSBC (Hongkong and Shanghai Banking Corporation) is a multinational banking and financial services company headquartered in London, United Kingdom. It is one of the largest banks in the world, with operations in over 60 countries and territories.

HSBC was originally founded in 1865 in Hong Kong to facilitate trade between China and Europe. Today, it provides a wide range of financial products and services to individuals, businesses, and institutions, including retail banking, commercial banking, investment banking, and wealth management.

Over the years, HSBC has been involved in several controversies, including allegations of money laundering, tax evasion, and other illegal activities. In 2012, the company agreed to pay a record $1.9 billion settlement to US authorities to settle charges of violating anti-money laundering and sanctions laws.

In 2015, HSBC was implicated in the Swiss Leaks scandal, which revealed that the bank’s Swiss unit had helped wealthy clients around the world evade taxes and conceal their assets. The scandal led to investigations and legal action in several countries against HSBC and some of its clients.

Despite these controversies, HSBC remains one of the largest and most influential banks in the world, with a significant presence in Asia, Europe, and the Americas.

Subsequently,

Swiss Leaks

It can be defined as the unauthorized release of confidential banking data, revealing the involvement of Swiss banks in facilitating tax evasion and money laundering activities. It refers to the leak of confidential documents, commonly known as the Swiss Leaks, that provided concrete evidence of individuals and entities using offshore accounts, shell companies, and illicit transactions to conceal wealth and evade taxes.

Historical Data

Swiss banking secrecy has a long history. For decades, Swiss banks offered privacy for wealthy clients seeking to protect assets. Strict laws allowed banks to operate discreetly.

However, global efforts to combat financial crimes increased. Swiss bank secrecy started to unravel. The Swiss Leaks scandal began when an HSBC Swiss employee leaked documents exposing illegal activities, causing an uproar.

The leaked documents, called Swiss Leaks, provided evidence that individuals and entities were using offshore accounts, shell companies and complex transactions to hide wealth and avoid taxes. The documents revealed intricate offshore schemes obscuring the true beneficiaries.

The investigation, published in 2015, led to public outrage and calls for more banking regulation. As global efforts to combat financial crimes intensified, the veil of Swiss banking secrecy began to unravel.

The scandal erupted when Hervé Falciani, a former HSBC Swiss private banking employee, leaked confidential documents to authorities and journalists. These documents, now known as the Swiss Leaks, exposed extensive illicit activities and sparked an international outcry.

The key takeaways: Swiss banking secrecy, though longstanding, started unraveling due to increased efforts to combat financial crimes. The Swiss Leaks scandal began when an HSBC employee leaked documents exposing illegal activities involving offshore accounts and shell companies. This caused public outrage and calls for more banking regulation.

The improved writing is more concise, uses clearer sentence structure and avoids repetition. Let me know if you’d like me to improve the text further.

Famous Quotes

“Swiss Leaks shed light on the shadowy world of offshore banking, where the wealthy few exploit legal loopholes to avoid paying their fair share of taxes.” Investigative Journalist

“The Swiss Leaks scandal exposed the dark underbelly of Swiss banking, tarnishing the reputation of an entire industry.” Financial Analyst

Now we are looking forward to know more about Examples, statistics and incidents

Examples

The Swiss Leaks scandal revealed many examples of how individuals and entities used Swiss banking secrecy for illegal activities. Wealthy people used Swiss bank accounts to hide wealth and avoid taxes in their home countries. The leaked documents showed complex offshore schemes that hid the true beneficiaries.

For example, a prominent businessman set up offshore companies and trusts with help from a Swiss bank. Through these, he channeled ill-gotten gains, avoided taxes and regulators. The leaked documents exposed the entire operation, showing the extent of his fraud.

The key details: The Swiss Leaks scandal revealed many practical examples of how people exploited Swiss banking secrecy for illegal activities. Wealthy individuals used Swiss accounts to hide wealth and evade taxes. The leaked documents showed intricate offshore schemes that obscured the true beneficiaries. The example of the prominent businessman setting up offshore entities with bank help to funnel illicit funds while evading taxes and scrutiny further illustrates this. The documents exposed this operation and the extent of his fraudulent activities.

The example of the prominent businessman further illustrates how individuals exploited Swiss banking secrecy for illegal gain.

As countless others did according to the leaked documents.

Statistics

- The Swiss Leaks documents consisted of approximately 60,000 files, containing information on over 100,000 clients of HSBC’s Swiss private banking division (ICIJ).

- The total value of assets held in these accounts was estimated to be around $100 billion (The Guardian).

- The leaked files implicated more than 100,000 individuals and entities from over 200 countries (BBC).

- Around 80% of the accounts associated with the Swiss Leaks scandal were held by individuals residing in Europe.

- The leaked data revealed connections to political figures, celebrities, and high-profile business tycoons.

The scale of the illicit activities facilitated by Swiss banks, as revealed in the leaked documents, was vast, Kyros uses cutting-edge technology like artificial intelligence and machine learning. This enables institutions to analyze vast amounts of data and detect suspicious activity.

Incidents

Several significant incidents emerged from the Swiss Leaks scandal, shedding light on the magnitude of the illicit financial activities facilitated by Swiss banks. These incidents include:

- The case of a prominent politician who was found to have amassed a significant fortune in offshore accounts held by a Swiss bank. The leaked documents exposed his involvement in bribery and corruption, leading to a subsequent investigation and legal action (Reuters).

- The discovery of a network of shell companies and front organizations used by criminal organizations to launder money through Swiss banks. The leaked documents provided crucial evidence that led to the dismantling of these illicit operations (SWI swissinfo.ch).

- The exposure of tax evasion schemes employed by multinational corporations to shift profits to Swiss subsidiaries and avoid paying taxes in their home countries. The leaked files revealed the extent of these practices, leading to increased scrutiny and calls for tax reforms (Tax Justice Network).

- The revelation of Swiss banks offering specialized services to wealthy clients, including providing assistance in creating complex offshore structures to evade taxes. The leaked documents demonstrated the complicity of these banks in facilitating financial crimes (Reuters).

- The collaboration between Swiss banks and individuals involved in organized crime, drug trafficking, and other illegal activities. The leaked files exposed the deep connections between illicit money flows and the Swiss banking sector (BBC).

Next, we are looking for the reaction of the swiss leak on the future.

The Future

The Swiss Leaks scandal has significantly influenced the future of the financial industry. It exposed the vulnerabilities of the global banking system and highlighted the urgent need for stronger anti-money laundering (AML) regulations, enhanced transparency, and more robust compliance measures.

In response to the scandal, Switzerland and other countries implemented stricter regulations and increased oversight of their financial sectors. The financial industry has also witnessed the emergence of advanced technologies and data analytics tools to improve AML efforts and detect potential risks more efficiently.

Looking ahead, the future of AML compliance will undoubtedly be shaped by the lessons learned from the Swiss Leaks scandal. Regulatory authorities are expected to continue strengthening AML frameworks, promoting information exchange between countries, and adopting more sophisticated technologies to detect and prevent financial crimes.

Therefore, with comprehensive features, Kyros empowers AML experts to proactively monitor potential money laundering and fraud risks.

Explore the Power of Kyros AML Data Suite

As an AML professional, you understand the importance of robust and efficient compliance measures to combat financial crimes effectively. In today’s complex regulatory landscape, manual AML processes are no longer sufficient. That’s where Kyros AML Data Suite comes in, offering a powerful solution to streamline your AML compliance efforts and enhance your risk management strategies.

Kyros AML Data Suite is an advanced AML compliance software designed to leverage cutting-edge technologies. It is such as artificial intelligence and machine learning. By harnessing the power of these technologies, Kyros AML Data Suite enables financial institutions to analyze vast amounts of data, detect suspicious activities, and ensure regulatory compliance.

With its comprehensive suite of features, Kyros AML Data Suite empowers AML professionals to proactively monitor and investigate potential money laundering and fraud risks.

Let’s explore some of the key benefits and functionalities of Kyros AML Data Suite:

Transaction Monitoring

Kyros AML Data Suite provides robust transaction monitoring capabilities, allowing you to analyze customer transactions in real-time. It employs advanced algorithms to detect unusual patterns, identify potential red flags, and generate alerts for further investigation.

Customer Due Diligence

Ensuring the integrity of your customer base is essential for effective AML compliance. Kyros AML Data Suite offers comprehensive customer due diligence features, enabling you to perform thorough risk assessments, verify customer identities, and screen against global watchlists and sanctions databases.

Risk Scoring and Alert Management

Prioritizing alerts and managing investigation workflows can be a daunting task. Kyros AML Data Suite automates the risk scoring process, assigning risk levels to customers and transactions based on predefined rules and machine learning algorithms. This helps you focus your resources on high-risk entities and streamline your investigation processes.

Regulatory Reporting

Meeting regulatory reporting requirements is a critical aspect of AML compliance. Kyros AML Data Suite simplifies the reporting process by generating accurate and comprehensive reports tailored to regulatory standards. This ensures timely submission of reports to the relevant authorities.

Data Integration and Visualization

Kyros AML Data Suite seamlessly integrates with your existing systems and data sources, consolidating data from various channels into a centralized platform. It provides intuitive visualizations and customizable dashboards, enabling you to gain actionable insights from complex data sets and make informed decisions.

By embracing the power of Kyros AML Data Suite, AML professionals can significantly enhance their compliance programs, improve operational efficiency, and mitigate financial crime risks. Stay one step ahead of money launderers, fraudsters, and other criminal elements by leveraging the advanced capabilities of Kyros AML Data Suite.

For more information about Kyros AML Data Suite and how it can transform your AML compliance efforts, visit kyrosaml.com. Empower your organization with the cutting-edge technology and comprehensive solutions offered by Kyros AML Data Suite, and reinforce your commitment to maintaining a safe and secure financial ecosystem.

Share article on