Resources

AML Residual Risk

AML residual risk continues to pose a persistent threat, requiring vigilant efforts to mitigate its impact. Delve...

Internal Audit (AML)

Internal audit plays a crucial role in ensuring the effectiveness and efficiency of an organization's anti-money laundering...

Inherent Risk

Inherent risk refers to the level of risk inherent in a business or industry that can potentially...

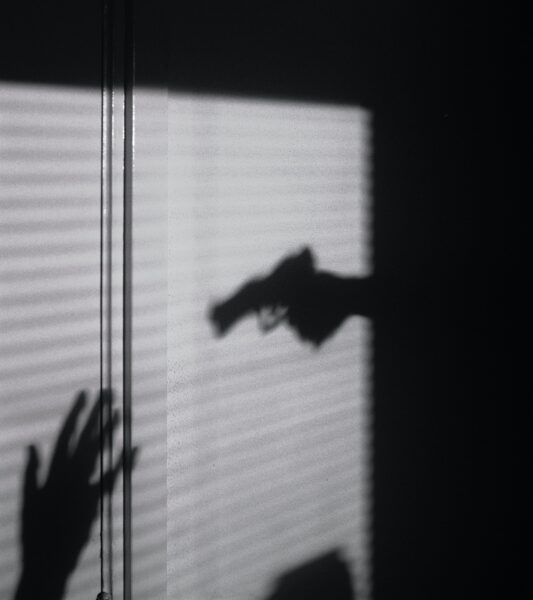

Organized Crime Groups (OCGs)

Dive into the world of organized crime groups (OCGs) and explore their hierarchical structure, secretive operations, and...

Digital Identity Verification

Digital identity verification plays a vital role in verifying the authenticity and integrity of individuals in the...

De-risking Strategy

Learn about de-risking strategy and how it helps financial institutions manage risks, streamline operations, and stay compliant...

Cultural Property Crime (CPC)

Discover the dark underworld of cultural property crime (CPC) and the ongoing battle to protect our global...

Cryptocurrency AML

Cryptocurrency AML, an abbreviation for Anti-Money Laundering, refers to the set of measures and practices aimed at...

Correspondent Banking Relationships

Delve into the world of correspondent banking relationships and their crucial role in facilitating cross-border transactions.

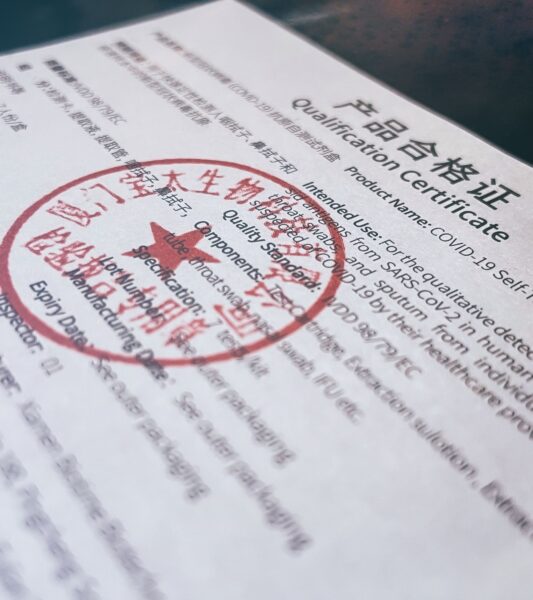

Certificate of Compliance

Understand the significance of certificate of compliance and its role in ensuring adherence to regulatory requirements.