Resources

Crypto Regulation in 2025: AI, Compliance, and the New Frontier

As we push further into 2025, the cryptocurrency market is hitting a major turning point—driven by tighter...

Double check your AML compliance for 2025: key steps to stay ahead

With regulatory scrutiny tightening worldwide, businesses can no longer afford to take a reactive approach to AML...

Future-Proof Your Compliance: 3 AML Essentials for 2025

As we start 2025, the regulatory landscape is evolving at an unprecedented pace. Businesses face growing pressure...

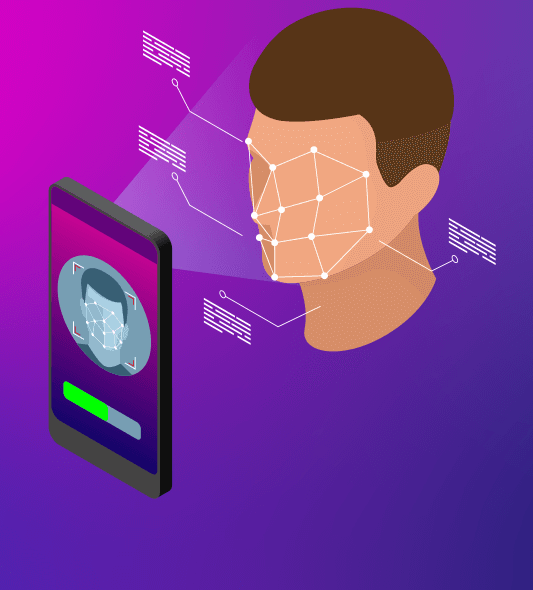

How to Increase Your Onboarding Conversion Rate

Onboarding is a critical touchpoint for businesses. A seamless and efficient onboarding process can be the difference...

What is AML and Why It Matters in 2025?

In an increasingly interconnected and digital world, the threat of financial crimes like money laundering continues to...

AML/CFT Standards: Ensuring a Secure Financial Landscape

"The fight against money laundering and terrorist financing is a global responsibility that requires collaboration and commitment...

Regulatory Backstop

"The presence of a robust regulatory backstop is instrumental in fostering confidence in the financial system and...

Customer Identification Program (CIP)

"The Customer Identification Program is not just a regulatory obligation; it is a critical tool in the...

Ultimate Beneficial Ownership (UBO) Registry

he Ultimate Beneficial Ownership (UBO) Registry plays a crucial role in identifying the individuals who ultimately own...

Non-Financial Businesses and Professions (NFBPs)

Non-Financial Businesses and Professions (NFBPs) encompass a wide range of industries and occupations that are vulnerable to...