Fintech AML & KYC Compliance Solutions

Compliance tools built for fast, digital-first financial products.

The Fintech industry moves quickly. New products launch every month, customer expectations rise, and regulators continue to tighten standards around onboarding, monitoring, and fraud prevention. Most teams try to balance growth with compliance, but that balance gets harder as volumes increase and the rules evolve.

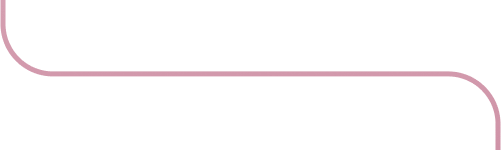

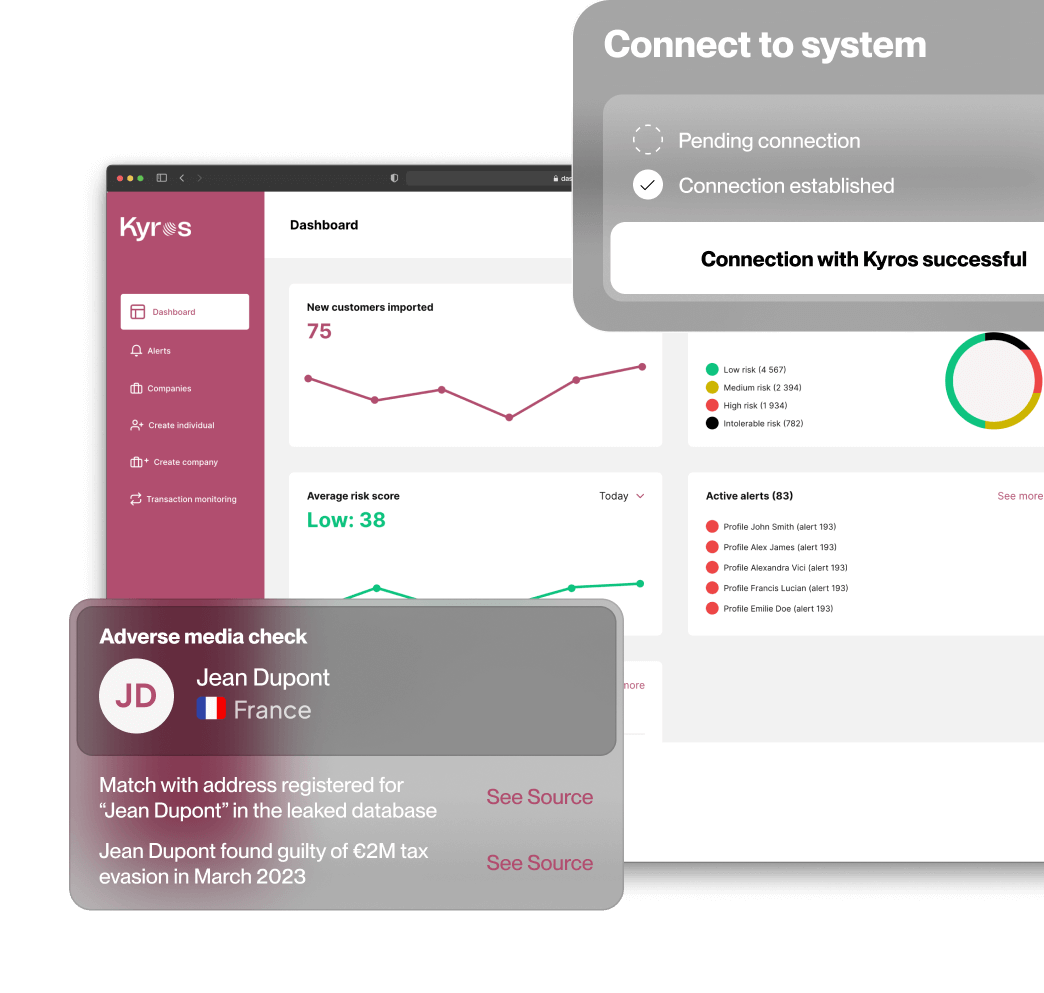

KyrosAML helps Fintech companies stay ahead of these demands with a modular platform that supports everything from identity checks to ongoing AML monitoring. It’s built for teams that need reliable compliance infrastructure without slowing down the user experience.

Why AML and KYC matter so much in Fintech

Fintech companies operate under banking-level scrutiny, even if they aren’t technically banks. Whether you’re offering payments, digital accounts, or lending, you’re expected to meet strict requirements around customer due diligence, sanctions screening, and transaction monitoring.

At the same time, customers expect onboarding to be instant. They want a smooth experience, not a compliance process that feels like paperwork. This is where modern, automated systems become essential.

What KyrosAML brings to Fintech teams

Smooth and secure onboarding

Our identity tools help you verify customers quickly without adding friction.

This includes:

- online ID checks, including EU eID flows

- passport and document verification

- biometric and liveness checks

- automatic extraction of verified data

It’s built to support high conversion while meeting regulatory expectations.

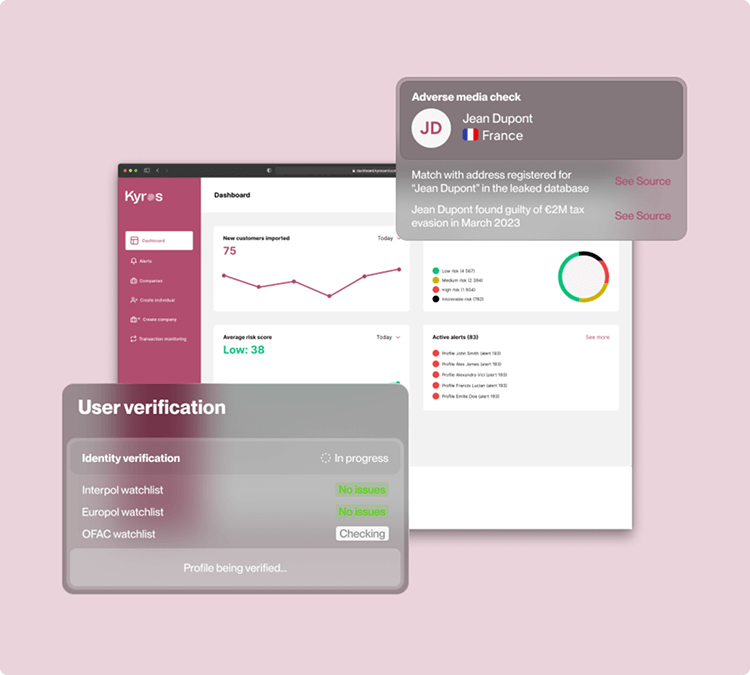

Real-time AML screening

Every customer is screened against global sanctions lists, PEP databases, and adverse media sources.

The system updates continuously, and screenings run instantly, so you never interrupt onboarding or daily operations.

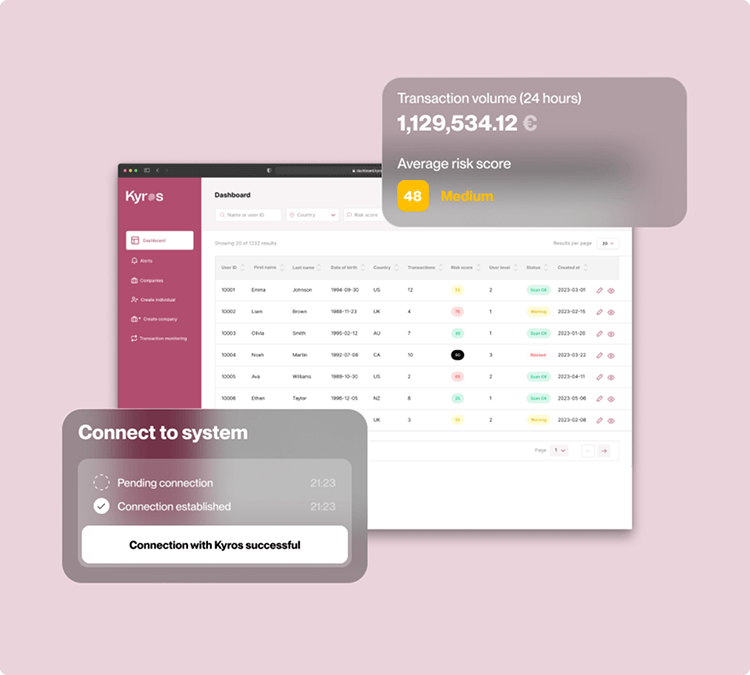

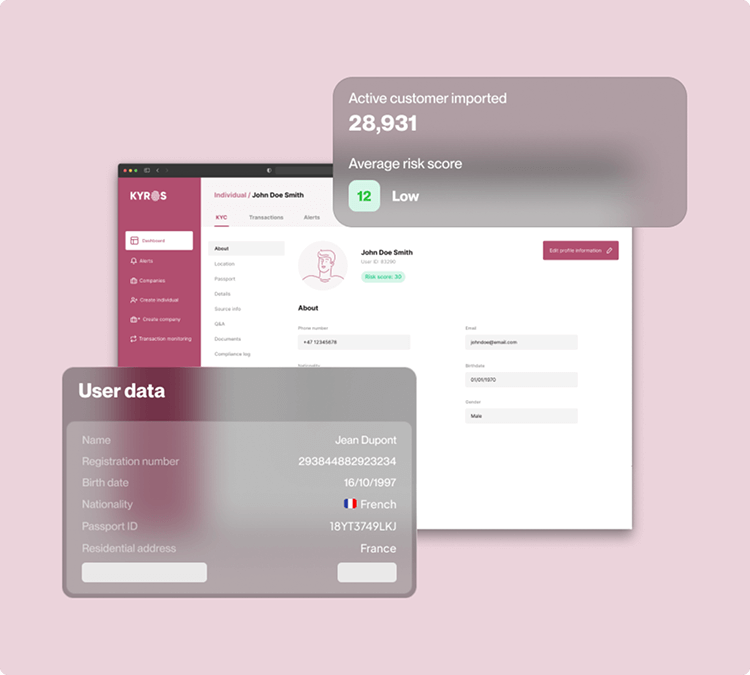

Transaction monitoring that adapts to your product

Fintech products all behave differently, so rigid rule engines don’t work.

KyrosAML allows you to set thresholds, behavioural triggers, and custom logic that fits your risk profile.

You can detect:

- abnormal spending or transfer patterns

- unusual account activity

- cross-border risk

- transactions linked to high-risk entities

Everything updates in real time.

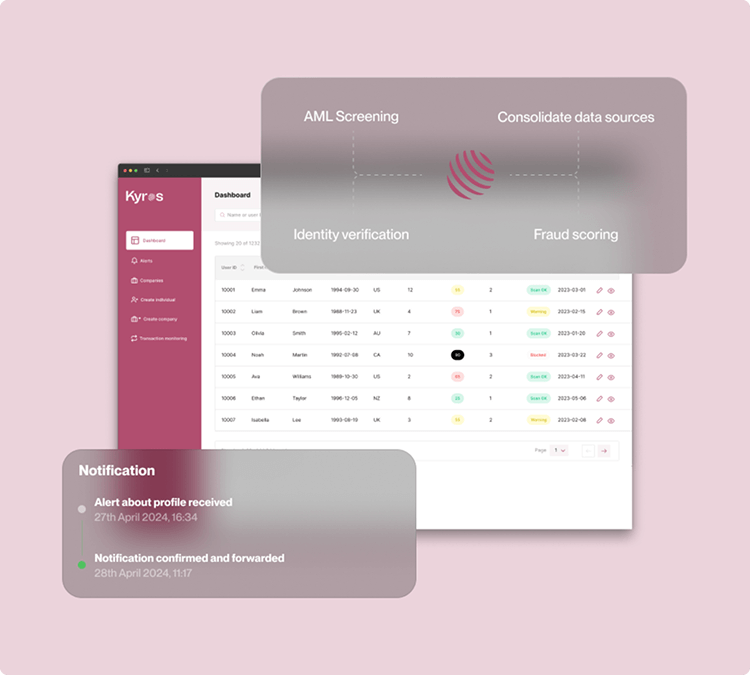

Intelligent risk scoring

Risk scoring combines customer information, behavioural signals, device data, and transaction patterns.

This makes it easier to spot unusual activity without drowning your team in false positives.

Case management built for modern terms

Investigations often get messy. We centralise everything—notes, evidence, checks, and audit logs—so your reviewers have a clear, complete view of each case.

Stronger customer profiles with data enrichment

Some decisions require more context.

KyrosAML enriches customer data with address checks, affordability insights, credit indicators, tax information, and adverse media results. This gives you a clearer picture and reduces unnecessary manual reviews.

Digital banking and neobanks

Handle onboarding, risk scoring, and account monitoring with banking-grade reliability.

Payment services and PSPs

Support instant payments while staying aligned with AML and PSD2 requirements.

Lending and credit platforms

Verify identity, assess affordability, and monitor repayment behaviour.

Money transfer and remittance apps

Manage cross-border risk and monitor transactions at scale.

Fintechs working with crypto

Combine blockchain analytics with traditional AML controls when your product touches digital assets.

Embedded finance platforms

Support brands and marketplaces offering financial features inside their products. KyrosAML helps manage risk and compliance behind the scenes so you can scale embedded payments, accounts, or lending without building a full compliance stack internally.

Why Fintech companies choose KyrosAML

- onboarding stays fast and simple

- compliance workflows scale with your user base

- screening and monitoring happen in real time

- everything is modular and API-first

- internal teams stay focused on high-value review work, not repetitive tasks

See KyrosAML in action

If you want to upgrade your fintech compliance stack without slowing down growth, we can walk you through the full platform and how it adapts to your workflows.